ladangmas234.site

Learn

Remitly Payment Methods

Select payment method and hit send. Choose what works best for you and your What are the different ways I can pay for my money transfer to Kenya? 7 digital payment services that let you transfer money · PayPal · Zelle® · Venmo · Cash App · Meta Pay · Google Pay · Apple Cash · Money transfer services FAQ. Send money worldwide. Remitly provides debit card delivery options through Visa and Mastercard. 5. Remitly vs. Other Money Transfer Services: Comparing Methods for Sending Money Abroad ; WorldRemit, Convenient online transfers, variety of payment methods. WorldRemit's Payment Methods · Bank transfer · Cash pickup · Mobile money, such as MTN Mobile Money, Airtel, and Tigo · Airtime top-up · Home delivery. Remitly offers several payment methods with best USD to MXN exchange rates. You can either choose to make a card payment, that is, you can use both debit or. Delivery method, Fee. Mobile money, $0. Cash pickup, $ Home delivery, $ Enter your payment information and select confirm transfer to send. Send. Remitly accepts bank transfers and cash payments and offers various payout options, including deposit to bank accounts, mobile wallets, cash pickup, and home. Select payment method and hit send. Choose what works best for you and your What are the different ways I can pay for my money transfer to Mexico? Select payment method and hit send. Choose what works best for you and your What are the different ways I can pay for my money transfer to Kenya? 7 digital payment services that let you transfer money · PayPal · Zelle® · Venmo · Cash App · Meta Pay · Google Pay · Apple Cash · Money transfer services FAQ. Send money worldwide. Remitly provides debit card delivery options through Visa and Mastercard. 5. Remitly vs. Other Money Transfer Services: Comparing Methods for Sending Money Abroad ; WorldRemit, Convenient online transfers, variety of payment methods. WorldRemit's Payment Methods · Bank transfer · Cash pickup · Mobile money, such as MTN Mobile Money, Airtel, and Tigo · Airtime top-up · Home delivery. Remitly offers several payment methods with best USD to MXN exchange rates. You can either choose to make a card payment, that is, you can use both debit or. Delivery method, Fee. Mobile money, $0. Cash pickup, $ Home delivery, $ Enter your payment information and select confirm transfer to send. Send. Remitly accepts bank transfers and cash payments and offers various payout options, including deposit to bank accounts, mobile wallets, cash pickup, and home. Select payment method and hit send. Choose what works best for you and your What are the different ways I can pay for my money transfer to Mexico?

Send money to a bank account using Remitly. Loved ones can receive their funds fast and securely.

Remitly offers a few different methods for funding payments, but most require you to have a bank account. You can pay for your transfer using your bank account. Join the millions of people who have trusted Remitly since to send money to friends and family overseas. More money makes it home to loved ones with. Payment systems, Data management, Customer experience, Application programming interfaces, Diagrams. Status. Grant. Learn more by requesting a demo. Latest. Multiple payment methods: Pay for your transfer using debit card, credit card, or ACH bank transfer. ; 24/7 customer support: Get help and. Cash pickup, bank deposit, and UPI in India · A.P. Mahesh Cooperative Urban Bank · Abhyudaya Cooperative Bank · Abu Dhabi Commercial Bank · Aditya Birla Payments. Cons · You can't link your account to credit card to use as payment method · You can't send money to international bank accounts · Recipients must sign up for. It often charges fixed fees around $4 for sending money, depending on the country, amount sent and payment method. Remitly's exchange rates. Payment Methods Available with Remitly Individual users can send up to $ per day, and Remitly doesn't allow you to set up recurring transactions. If you. Remitly accepts payment via bank transfer, debit card, and credit card only. The recipients can then claim the funds via bank account deposit, direct cash pick-. The company's rates and fees are superb. For example, when you use the Remitly Express option, you can expedite your transfers within minutes for just $ If. Choose a payment method that works for you, such as a debit or credit card. Sign up and start your online money transfer today. Get started now. See what our. Choose delivery method. 4. Enter your recipient information. 5. Select payment method and hit send What are the different ways I can pay for my money transfer. Remitly helps you send money worldwide and pay using your bank account, credit card, or debit card. More money makes it home to friends and family thanks to. Payment Methods · In-Person Payments. Risk & Operations. Fraud Protection Choose your payment type and payment method; Review the transaction. Open the Remitly app · Tap on "My Remitly" · Select "Payment methods" · Tap the "Edit" button next to the payment method you want to update · Add your Comun account. Select payment method and hit send. Choose what works best for you and your What are the different ways I can pay for my money transfer to Pakistan? Step 1: Create a free account · Step 2: Select country · Step 3: Enter recipient's information · Step 4: Choose your payment method · Step 5: Confirm your. Our disbursement network provides our customers with a choice of various digital and traditional delivery methods and enables us to disburse (or pay-out) funds. Pay for your transfer Choose how you'd like to pay for your transfer: bank deposit, credit or debit card. Payment methods for international transfers. We. Sofort is a payment method available in Germany and Austria that lets you pay for your Remitly transfer using your online banking account.

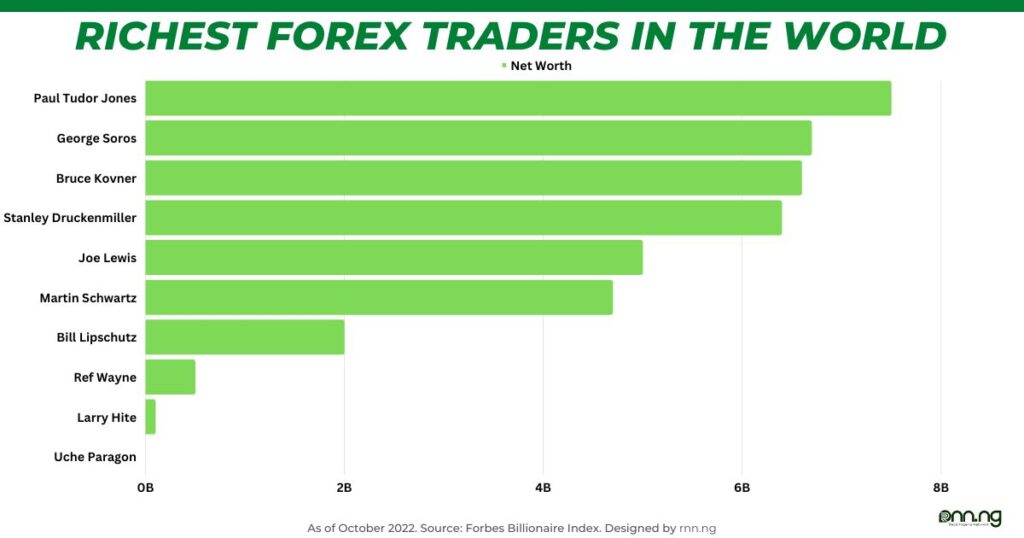

Richest Options Trader

Bill Lipschutz, one of America's wealthiest forex traders, has a net worth of approximately $2 billion. His trading journey began with a $12, inheritance. 76 Jenny Just on the America's Self-Made Women - Jenny Just started out as an options trader in Chicago, then cofounded options trading firm Peak6. 1. The Maestro of Macro: George Soros A name synonymous with financial wizardry, George Soros needs no introduction. His audacious “breaking. Richest option trader in the world. 5 minutes scalping strategy is a popular trading method used by traders to take advantage of short-term market fluctuations. Although he died more than half a century ago, Livermore is considered by today's top traders as the greatest trader who ever lived. An enigmatic loner. Nial Fuller is a Professional Trader, Investor & Author who is considered 'The Authority' on Price Action Trading. His blog is read by over ,+ followers. In March , an unidentified trader made a profit of over $ million in just 28 minutes by buying $, worth of calls on Altera stock. One of the most famous traders nowadays is Ross Cameron, who made a fortune of $, in Another well-known trader is Sasha Evdakov, who also. 1> George Soros: While primarily known as a macro investor, Soros has utilized options strategies effectively in his trading career, especially. Bill Lipschutz, one of America's wealthiest forex traders, has a net worth of approximately $2 billion. His trading journey began with a $12, inheritance. 76 Jenny Just on the America's Self-Made Women - Jenny Just started out as an options trader in Chicago, then cofounded options trading firm Peak6. 1. The Maestro of Macro: George Soros A name synonymous with financial wizardry, George Soros needs no introduction. His audacious “breaking. Richest option trader in the world. 5 minutes scalping strategy is a popular trading method used by traders to take advantage of short-term market fluctuations. Although he died more than half a century ago, Livermore is considered by today's top traders as the greatest trader who ever lived. An enigmatic loner. Nial Fuller is a Professional Trader, Investor & Author who is considered 'The Authority' on Price Action Trading. His blog is read by over ,+ followers. In March , an unidentified trader made a profit of over $ million in just 28 minutes by buying $, worth of calls on Altera stock. One of the most famous traders nowadays is Ross Cameron, who made a fortune of $, in Another well-known trader is Sasha Evdakov, who also. 1> George Soros: While primarily known as a macro investor, Soros has utilized options strategies effectively in his trading career, especially.

The delta value of an option is often used by traders and investors to inform their choices for buying or selling options. Delta values can be either positive. Radhakishan Damani - Radhakishan Damani, often known as 'Mr. White and White' due to his basic attire of a white shirt and white pants, is India's wealthiest. In fact, Binary Options Brokers deployed the very best internet marketing strategies to quickly saturate potential investors and traders with messages of how. A stock trader or equity trader or share trader, also called a stock investor, is a person or company involved in trading equity securities and attempting. Williams - made $1 million out of $10 thousand in a year; Steven A. Cohen - net worth of $9,2 billion; Paul Tudor Jones - net worth of $5 billion; John D. Top 10 – for serving Wealthy Traders. Top 10 – for serving Occasional Winner Options Analysis Software (Trader Workstation ) 1st Runner. Follow. ladangmas234.siteal. Deepak Wadhwa | Option Trader | Stock Market Coach. Follow. bhajanmarg_official. Bhajan Marg Official. Follow. ladangmas234.sitesee. For investors, this can be beneficial for a wide variety of reasons and this makes CFDs an excellent trading option for active traders that might not be focused. Jesse Lauriston Livermore (July 26, – November 28, ) was an American stock trader. He is considered a pioneer of day trading and was the basis for. Another alternative for security-conscious but still active traders can be Options form. Who is the richest day trader? It is impossible to determine the. The wealthiest trader in the world is George Soros, whose fortune is billion dollars ($ 6,). They managed clients' money actively from to. There is a very good reason that the U.S Securities and Exchange Commission has qualification rules in place for investors who want to trade options as there is. Paul Tudor Jones is an American billionaire hedge fund manager and is the th richest person in the world. Paul is the founder of a $ billion hedge fund. In this course I reveal a closely guarded options strategy used by Wall Street professionals to gain an edge in the markets. Even the richest investor in. They give many of their employees £10 to start trading and require them to invest everything on every trade. Most of their traders will lose this money, which. Investor $SPY & options trader Helping struggling traders become profitable is my mission in life. Richest option trader in the world. They have a wide range of reputable broker partners, which gives traders a variety of options to choose from. Sivakumar Jayachandran is an ace scalper with over 15 years of experience and one of the rare traders who has generated consistent returns by buying options. Takashi Kotegawa (aka BNF/J-Com man) is one of Japan's most famous day traders. He's also one of the most famous traders in the business. 1. Ross Cameron: Is he the Best Forex Day Trader in the world? · 2. Sasha Evdakov. · 3. Rayner Teo. · 4. What Made Steven A. · 5. Mark Minervini: Net Worth Is.

Car Insurance A Month Price

According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month. It can cost as little as $ monthly or $ annually for businesses such as yoga instructors and accountants, but the exact commercial auto insurance cost. The average cost of car insurance ranges from $ to $ per month for a liability-only policy from Progressive. And the payout is the amount up to which an insurance provider will make you whole. The policy is usually set for a term of 6 or 12 months, where the insured. Need car insurance? USAA offers competitive rates, discounts and exceptional service to military members and their families. Get an auto quote today. Get accurate estimates of your car insurance costs with Insurify's car insurance calculator. Learn about how rates are calculated here. The average monthly premium for minimum coverage in California is $ · Drivers in Los Angeles, according to our research, pay an average rate for full coverage. Drivers in the U.S. pay an average of $1, per year for full coverage car insurance, or about $ per month, according to Bank rate's Generally speaking, the average cost is about $1, However, this number can only tell drivers so much because different states all have their own average car. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month. It can cost as little as $ monthly or $ annually for businesses such as yoga instructors and accountants, but the exact commercial auto insurance cost. The average cost of car insurance ranges from $ to $ per month for a liability-only policy from Progressive. And the payout is the amount up to which an insurance provider will make you whole. The policy is usually set for a term of 6 or 12 months, where the insured. Need car insurance? USAA offers competitive rates, discounts and exceptional service to military members and their families. Get an auto quote today. Get accurate estimates of your car insurance costs with Insurify's car insurance calculator. Learn about how rates are calculated here. The average monthly premium for minimum coverage in California is $ · Drivers in Los Angeles, according to our research, pay an average rate for full coverage. Drivers in the U.S. pay an average of $1, per year for full coverage car insurance, or about $ per month, according to Bank rate's Generally speaking, the average cost is about $1, However, this number can only tell drivers so much because different states all have their own average car.

Your responses will help you get the right level of protection for a great price. Learn more about factors that impact your car insurance coverage needs. The. The average annual cost for full coverage car insurance is $1,, roughly $ a month and is $ for minimum coverage, roughly $41 per month. Minimum. How we price car insurance. With Root, your driving behavior is the #1 factor I switched from Geico, paid 6 months upfront and went from $1,/6 months to. Car insurance costs $60 per month, on average, for a minimum coverage policy, although individual rates might vary. Full coverage car insurance is more. The national average cost of car insurance in is roughly $ per year (or $64 per month). This average rate is for a minimum coverage policy. Minimum liability car insurance cost in CA is $48 per month or $ per year in Getting minimum auto insurance in California is not recommended, as it. Get accurate estimates of your car insurance costs with Insurify's car insurance calculator. Learn about how rates are calculated here. How much is the average cost of car insurance in the U.S? The average cost for car insurance in the United States is $1, per year, or $ per month. Car insurance rates by model. Compare average car insurance rates for new cars for the top + car models. Search your car. Model. Make. Monthly insurance rate. Factors that affect car insurance rates · Age · Location · Driving record · Claims history · How often you drive · Credit score · Vehicle · Your policy coverages. The average cost of auto insurance in the U.S. is $ for a six-month policy. But car insurance rates depend on a number of factors — let's dive into the data. Geico car insurance costs an average of $ per year ($66 per month) for a minimum-coverage policy, which is less than the national average of $ per year. Car insurance rates average $ in Texas. Compare quotes from State Farm, GEICO, Allstate, and more. Car insurance costs $60 per month, on average, for a minimum coverage policy, although individual rates might vary. Full coverage car insurance is more. Shopping for car insurance is simple with Mercury Insurance. We offer auto insurance coverage to meet all needs at affordable rates! Get a quote today! Average Cost of Car Insurance by State ; Georgia. $ $ ; Hawaii. $ $ ; Idaho. $ $ ; Illinois. $ $ And the payout is the amount up to which an insurance provider will make you whole. The policy is usually set for a term of 6 or 12 months, where the insured. Our research shows that drivers pay an average cost of $50 per month for car insurance rates in Chicago. car insurance calculator recommends a minimum set of coverages for your situation. For a full car insurance cost estimate, get a car insurance quote today. The average full coverage car insurance cost is $1, per year, or about $ per month, according to ladangmas234.site's most recent data. That's based on.

Home Loan In Usa For Property In India

You can get a mortgage for an overseas property, as long as the lender works internationally and the country allows noncitizens to buy property there. We facilitate equitable and sustainable access to homeownership and quality, affordable rental housing across America. ICICI Bank provides Mortgage Loan for NRI: Specialized mortgage loans are designed for Non-Resident Indians (NRIs) seeking to purchase property in India. NRIs are allowed to repatriate or bring their sale proceeds of property sold in India to the US. Also, if the NRI purchased the property via a home loan, then. We are supporting America's homeowners and renters while serving as a stabilizing force in the U.S. housing finance system. Let us help find the home loan that's right for you. Our home loans — and low home loan rates — are designed to meet your specific home financing needs. An overseas mortgage is any mortgage you take out on a property that's not in your country of residence. It can be from a local bank, or from an overseas lender. No, you cannot claim an India home loan in the USA. Home loans are typically offered by financial institutions and banks in the country where the property is. Well the answer to the question is yes, an NRI can get a home loan just like any resident Indian by any Indian bank or Non Banking Financial Company (NBFC). The. You can get a mortgage for an overseas property, as long as the lender works internationally and the country allows noncitizens to buy property there. We facilitate equitable and sustainable access to homeownership and quality, affordable rental housing across America. ICICI Bank provides Mortgage Loan for NRI: Specialized mortgage loans are designed for Non-Resident Indians (NRIs) seeking to purchase property in India. NRIs are allowed to repatriate or bring their sale proceeds of property sold in India to the US. Also, if the NRI purchased the property via a home loan, then. We are supporting America's homeowners and renters while serving as a stabilizing force in the U.S. housing finance system. Let us help find the home loan that's right for you. Our home loans — and low home loan rates — are designed to meet your specific home financing needs. An overseas mortgage is any mortgage you take out on a property that's not in your country of residence. It can be from a local bank, or from an overseas lender. No, you cannot claim an India home loan in the USA. Home loans are typically offered by financial institutions and banks in the country where the property is. Well the answer to the question is yes, an NRI can get a home loan just like any resident Indian by any Indian bank or Non Banking Financial Company (NBFC). The.

Home and Property Disaster Loans. The U.S. Small Business The Native American Direct Loan (NADL) program makes home loans available to. NRI Home Loans are available with lowest interest rate starting from % pa. You can take an NRI housing loan for a wide range of housing needs. For NRIs seeking to buy a home in India, an HDFC Bank Home Loan is a great way to fund that investment. Attractive interest rates, transparent processes and. Generally, banks secure mortgage loans with ownership or leasehold interests in real property. In Indian country, the United States often holds the title to. To apply for a home loan in India, you can contact Indian banks or financial institutions that offer NRI home loans, either online or through their NRI. Is is absolutely possible for a new resident to obtain a mortgage from an Italian Bank. Please send us an email and we will put in contact with our Italian Bank. real estate price trends in the U.S.. Servicing. Best-in-class servicing solutions to help manage all aspects of loan servicing — from loan boarding to default. Can an NRI/OCI apply for a Home Loan in India? State Bank of India is the largest Mortgage Lender in India, which has helped over 30 lakh families achieve their dreams of owning a home. Explore the top mortgage lenders and land down payments as low as 0% to 15%. Find the perfect home loan lender with Forbes Advisor. SBI NRI Home Loan allows many NRIs (Non Resident Indians) to get home loans when investing in properties. Financially, it makes sense to purchase a property. HSBC offers mortgage solutions for foreign nationals looking to buy property in the US. Learn more about the US home buying process and how to start your. Did You Know? · You can avail of Home Loan Advisory Services in the country where you currently reside, for purchase of property located in India. · You can avail. Important · FHA loans · State homebuyer assistance programs · Home buying help for specific groups · American Indians and Alaska Natives · Veterans and service. Know your rights. Fair Housing: Equal Opportunity for All - brochure; Real Estate Settlement Procedures Act (RESPA) Indian Home Loan Guarantee Program . If you live abroad but want to buy property in the U.S., it may be easiest to obtain a home loan through your international lender if they operate in North. You can get a mortgage for an overseas property, as long as the lender works internationally and the country allows noncitizens to buy property there. Most U.S. Can I Get Home Loan in USA for Home in India? . You will have to take a home loan in India for your property in India. The process of taking an NRI home loan. If you're staying overseas and looking to fund the purchase of a property home in India, it's easy to opt for NRI Home Loan services from IIFL Home Loans. As a global mortgage specialist, HSBC offers home loans and international bank accounts around the world so you can finance your overseas properties.

Where To Deposit Money On Chime Card

Walgreens and Duane Reade These two retailers allow you to load your Chime card without any additional fees. Simply visit the cashier at a. Pick your payment option. Choose whether to pay with your credit3/debit card or with your bank account. You can add money to your Chime Checking Account by making a fee-free cash deposit5 at any Walgreens location nationwide. And it's not just Walgreens – for a. If you're asking if you can deposit cash into your Square debit card account, the answer is no. The only way to get funds into that account is through your. Add money1. Direct Deposit. Receive all or a portion of your pay directly into Add your Card to Apple Pay®, Samsung Pay® or Google Pay™ for. Method 3: Use Your Chime Debit Card · Open Cash App and click “Banking.” · Select “Add Debit Card” and enter your Chime details. · Confirm the link between your. Setting up direct deposit is the best way to add money to your Chime Account. When you set up direct deposit, you get access to some of Chime's most popular. You can deposit cash to your Chime Spending Account at over 90, retail locations (like Walmart, Walgreens, and 7-Eleven): Ask the cashier to make a deposit. Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to. Walgreens and Duane Reade These two retailers allow you to load your Chime card without any additional fees. Simply visit the cashier at a. Pick your payment option. Choose whether to pay with your credit3/debit card or with your bank account. You can add money to your Chime Checking Account by making a fee-free cash deposit5 at any Walgreens location nationwide. And it's not just Walgreens – for a. If you're asking if you can deposit cash into your Square debit card account, the answer is no. The only way to get funds into that account is through your. Add money1. Direct Deposit. Receive all or a portion of your pay directly into Add your Card to Apple Pay®, Samsung Pay® or Google Pay™ for. Method 3: Use Your Chime Debit Card · Open Cash App and click “Banking.” · Select “Add Debit Card” and enter your Chime details. · Confirm the link between your. Setting up direct deposit is the best way to add money to your Chime Account. When you set up direct deposit, you get access to some of Chime's most popular. You can deposit cash to your Chime Spending Account at over 90, retail locations (like Walmart, Walgreens, and 7-Eleven): Ask the cashier to make a deposit. Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to.

Capital One. "Account Disclosures." Chime. "How to Deposit Cash Into Your Chime Account." Finovate. "Chime Allows Users To Make Cash Deposits at Walgreens for. The Chime® Visa® Debit Card is issued by The Bancorp Bank, N.A. or Stride Bank pursuant to a license from Visa U.S.A. Inc. The secured Chime Credit Builder Visa. First Google out any nearby retail store from your nearby current location. · Now visit the store with your Chime card. · Once you reach the store. card provider if you can use Allpoint+ for cash deposits. Help! I made a deposit at an Allpoint+ location, but the money's not in my account! We're sorry. Just tell the cashier you want to load cash onto your chime card, hand them the cash and swipe the card. Did this once at a CVS before Chime. card, early direct deposit, and common Wisely FAQs icon of hand with money in it, for add money to card. Add Money · icon of. Go to your card info: · Enter an amount and tap Next. · Tap Instant Transfer. · If you haven't added an eligible debit card, tap Add Card and follow the. Dare accepted. You can now deposit cash into your Chime Checking Account fee-free at any of the + Walgreens® stores. Shoutout to Walgreens for. See deposit product details for accounts including CDs, checking, money market and savings accounts plus reviews, fee information and bank details for. because the terms and fees are different with. every prepaid card. and sometimes they don't even have this option. the last thing you can do. is give the money. You can add the money loaded by going to any nearest store. But the maximum limit is $ If you want to add more money, then you must go to. Yes! You can deposit cash into your Chime Checking Account without fees at more than 8, Walgreens and Duane Reade locations. Here's how it works. Just hand the cashier your cash, they'll swipe your card, and your money will load automatically. Retail service fee of up to $ applies. You can deposit cash into your Chime account at retailers like Wal-Mart, 7-Eleven, Walgreens, CVS, Dollar General, etc) (How do I deposit cash in my Chime. There are multiple ways to transfer money into your Credit Builder Secured Deposit Account. Use the Move My Pay feature in the Chime app: Your available-to-. Withdraw cash at places you love like Walgreens®, 7-Eleven®, CVS Pharmacy®, and Circle K · Deposit cash5 at any Walgreens® location · Find a fee-free location. Want to learn how to add money to your Wisely account? Visit Wisely's FAQ section for instructions on how to add or transfer money to your Wisely card. Deposit a check via mobile upload or mail a paper check. Transfer money from one Fidelity account to another. Transfer money via a third-party payment app like. To continue to get money in your Chime account, set up direct deposit from your employer or payroll provider. You can also deposit cash fee-free at any of the. You can also receive a debit card to get cash from more than 60, fee-free ATMs — and use Chime's mobile app to find the nearest machine. However, fees.

How To Open A Laundromat

How to Start a Laundromat · 1. Select a location · 2. Decide which services your laundromat will offer · 3. Calculate your expenses and purchase equipment · 4. LFS has the laundry financing you need – flexible programs, low rates, and laundry industry expertise. Whether you are starting up a new laundromat or upgrading. Steps to start a coin laundromat: · Conduct local market research · Build a business plan and find a location · Secure financing and licenses · Gather essential. Are you considering becoming a laundromat business owner? Opening a coin laundry business is a great way to be your own boss while driving profits in a stable. We've put together this 7-step guide to help our future partners learn everything they need to know about opening a laundromat. A laundromat is a business like any other, and location is vital to your success. A community that needs a coin-operated laundry but doesn't have one is a. The first step is to do your research. It's important to understand what a laundromat business entails: providing an appropriate space where customers can wash. Join Open Studios to meet the current cohort of Create Change AiRs and The Laundromat Project Fulton St, Brooklyn, NY ladangmas234.site 1. Select a location · 2. Decide which services your laundromat will offer · 3. Calculate your expenses and purchase equipment · 4. Acquire funding, choose a. How to Start a Laundromat · 1. Select a location · 2. Decide which services your laundromat will offer · 3. Calculate your expenses and purchase equipment · 4. LFS has the laundry financing you need – flexible programs, low rates, and laundry industry expertise. Whether you are starting up a new laundromat or upgrading. Steps to start a coin laundromat: · Conduct local market research · Build a business plan and find a location · Secure financing and licenses · Gather essential. Are you considering becoming a laundromat business owner? Opening a coin laundry business is a great way to be your own boss while driving profits in a stable. We've put together this 7-step guide to help our future partners learn everything they need to know about opening a laundromat. A laundromat is a business like any other, and location is vital to your success. A community that needs a coin-operated laundry but doesn't have one is a. The first step is to do your research. It's important to understand what a laundromat business entails: providing an appropriate space where customers can wash. Join Open Studios to meet the current cohort of Create Change AiRs and The Laundromat Project Fulton St, Brooklyn, NY ladangmas234.site 1. Select a location · 2. Decide which services your laundromat will offer · 3. Calculate your expenses and purchase equipment · 4. Acquire funding, choose a.

open thousands of profitable laundromats. To get you started, download Everything you need to know about starting a laundromat business. Download. Commercial washers and dryers cost between $ – $2, apiece, and typically last years. A typical laundromat will have between 40 and washers and. How To Start A Laundromat LLC Starting a laundromat business is a viable option to earn passive income. A profitable laundromat will generate consistent. Decide on a business model · Write your business plan · Understand the startup costs to open a laundromat · Assess the ongoing expenses to run a laundromat. I want to buy a laundromat but don't know where and how to start. Anyone can give some input on how to start on this business? Steps to start a coin laundromat: · Conduct local market research · Build a business plan and find a location · Secure financing and licenses · Gather essential. The Coin Laundry experts at A C Power can guide you through starting a laundromat business, incl. the best laundromat equipment, financing & marketing. In this special post, we will look at some tips for entrepreneurs who want to open their own hybrid laundromat. Want to open a laundry business? Be sure to know these things. Want the best coin laundry equipment in Raleigh, NC? Call T & L today to save time and money! If you're starting a laundromat business, partnering with a proven provider will give you a fast head start and ongoing support that you can trust. 8 steps to starting a laundry business · 1. Do your research · 2. Decide what kind of laundry business you want to start · 3. Buy a Laundromat · 4. Choose a name. Normally, it'll cost $ to $ to launch a mid-size laundromat. Learn all about the costs, or apply for finance with Swoop here. Although you must make a significant investment to get started in the laundry business, laundromat business owners report that small to medium-sized laundromats. Laundromat Startup Equipment List · Security System – $2, to $7, · Washers – $1, to $6, each · Dryers – $ to $5, each · Banking ATM – $2, Learn how to set up a successful laundry business. Explore the positives and negatives, costs and earnings for cleaning businesses. Make sure you can get building permits for your laundromat. Buy and install washers and dryers that are “coin operated” (might not use coins). Build your business in 4 key stages. Setting up a successful laundromat involves a series of critical commercial decisions and processes. Welcome to the new Business Services website! Provide Feedback Opens in new window |. Open Menu Laundromat. An establishment with coin-operated washing. Laundry equipment is the most critical expense when starting a laundromat. This includes washers, dryers, folding tables, carts, and detergent dispensers. For. Purchase the Right Equipment. If you're thinking of how to start a laundromat with no money, you can take equipment financing to purchase washing machines.

High Yield Savings Account Vs Mutual Funds

Instead, you may be better off looking into an investment account that lets you buy stocks, bonds, mutual funds, or exchange-traded funds (ETFs). While they're. Short-term Goals: High-yield savings accounts are preferable due to their liquidity. Long-term Goals: Bonds or are ideal for long-term, low-risk investments. When you save money in a bank account or CD, you earn a steady amount of interest and keep your principal intact. When you invest in the stock market or real. Investing and saving for a big purchase. Reach your goals faster by putting your money to work with investments or high interest savings accounts. A wedding. mutual funds or ETF s. In the end, it's up to you – you can decide how to invest your TFSA savings based on your risk tolerance. Not sure how much risk you. You can also invest in stocks and bonds through RBC Direct Investing and RBC Dominion Securities. An RBC advisor can help you decide which investments will best. For this purpose, high-yield savings accounts are a great option because they come with zero risk — meaning your money will always be there. When you invest. of fund is to maximize monthly income for unitholders while preserving capital and liquidity by investing primarily in high interest deposit accounts. High-yield savings accounts and money market accounts typically come with higher annual percentage yields (APY) than standard savings accounts. Instead, you may be better off looking into an investment account that lets you buy stocks, bonds, mutual funds, or exchange-traded funds (ETFs). While they're. Short-term Goals: High-yield savings accounts are preferable due to their liquidity. Long-term Goals: Bonds or are ideal for long-term, low-risk investments. When you save money in a bank account or CD, you earn a steady amount of interest and keep your principal intact. When you invest in the stock market or real. Investing and saving for a big purchase. Reach your goals faster by putting your money to work with investments or high interest savings accounts. A wedding. mutual funds or ETF s. In the end, it's up to you – you can decide how to invest your TFSA savings based on your risk tolerance. Not sure how much risk you. You can also invest in stocks and bonds through RBC Direct Investing and RBC Dominion Securities. An RBC advisor can help you decide which investments will best. For this purpose, high-yield savings accounts are a great option because they come with zero risk — meaning your money will always be there. When you invest. of fund is to maximize monthly income for unitholders while preserving capital and liquidity by investing primarily in high interest deposit accounts. High-yield savings accounts and money market accounts typically come with higher annual percentage yields (APY) than standard savings accounts.

Instead, you may be better off looking into an investment account that lets you buy stocks, bonds, mutual funds, or exchange-traded funds (ETFs). While they're. An RRSP is not an investment product or fund, but instead is an account that can hold cash, GICs, bonds, mutual funds, ETFs, stocks and other qualified. Explore the Investments tab for BlackRock's best ideas. Fundrise is a platform that gives you access to several different private funds, each calibrated for consistent growth and tailored to your unique investing. Money market funds can be a sound alternative to traditional bank accounts or certificates of deposit (CDs). Relative to these products, they generally combine. Easily retrieve funds from a money market mutual fund to get cash, pay a bill, or make another investment in your account. Market-based yields. We are focused. Overall benefits · Offers higher returns than a chequing account · Reduces the risks associated with market volatility · Available in all types of registration . While your money might be growing in a high-yield savings account, it still isn't growing as fast as it might compared with other methods of investing. In the. The money you deposit in a high-yield savings account earns interest based on the account's annual percentage yield (APY) and the compounding period (daily. Whether you're saving for a big purchase or just starting out, we can help you reach your goals. Investing automatically makes saving easier. Investing on a. Current performance may be lower or higher than the performance quoted. SCHWAB BANK INVESTOR SAVINGS™ ACCOUNT. % APY3. mutual funds (money market funds) and bank deposit solutions designed Mutual Funds or deposits for Bank Deposits can be completed to obtain these yields. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before. Available for registered and non-registered investments, this account is an ideal vehicle for your short-term cash requirements. How are ETFs and mutual funds different? · ETFs. While they can be actively or passively managed by fund managers, most ETFs are passive investments pegged to. Term deposits are more predictable but offer lower returns, while mutual funds provide potential for higher return but come with market risk. mutual funds (money market funds) and bank deposit solutions designed Mutual Funds or deposits for Bank Deposits can be completed to obtain these yields. or mutual funds. Cash is the most common, though bonds are also an option. 2 A High-Interest Savings Account, sometimes referred to as a high-yield. Lower Yield than Investing While a High Yield Savings Account offer better yields than standard savings accounts (sometimes 10x higher, or more), their. While your money might be growing in a high-yield savings account, it still isn't growing as fast as it might compared with other methods of investing. In the.

3 4 5 6 7