ladangmas234.site

Market

What Are Federal Tax Rates For 2021

Heads of Households ; Taxable Income. Tax ; Not over $14, 10% of taxable income ; Over $14, but not over $54, $1, plus 12% of the excess over. In , there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket depends on taxable income and filing status. tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, To calculate the Colorado income tax, a “flat” tax rate of percent is applied to federal taxable income after adjusting for state additions and. Current Tax Rates ; Personal Income Tax, percent ; Inheritance and Estate Tax, 0 percent on transfers to a surviving spouse or to a parent from a child aged. Combined Federal and Personal Tax Rates for (British Columbia). Income %, %. *** The rate reflects the rate that had been. RRSP savings calculator. Calculate the tax savings your RRSP contribution generates. · Canadian corporate tax rates for active business income. Tax Year Vermont Rate Schedules · Vermont Tax Tables. Tax Year Popular. Property Tax Credit · Estimated Income Tax · Property Tax Bill. Tax brackets may be based on indexed estimates. Statistics and factual data and other information are from the Canada. Revenue Agency and Tax Templates Inc. Heads of Households ; Taxable Income. Tax ; Not over $14, 10% of taxable income ; Over $14, but not over $54, $1, plus 12% of the excess over. In , there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket depends on taxable income and filing status. tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, To calculate the Colorado income tax, a “flat” tax rate of percent is applied to federal taxable income after adjusting for state additions and. Current Tax Rates ; Personal Income Tax, percent ; Inheritance and Estate Tax, 0 percent on transfers to a surviving spouse or to a parent from a child aged. Combined Federal and Personal Tax Rates for (British Columbia). Income %, %. *** The rate reflects the rate that had been. RRSP savings calculator. Calculate the tax savings your RRSP contribution generates. · Canadian corporate tax rates for active business income. Tax Year Vermont Rate Schedules · Vermont Tax Tables. Tax Year Popular. Property Tax Credit · Estimated Income Tax · Property Tax Bill. Tax brackets may be based on indexed estimates. Statistics and factual data and other information are from the Canada. Revenue Agency and Tax Templates Inc.

Rates for Tax Years ; Not over $10, 4% of the taxable income. ; Over $10, but not over $40, $, plus 6% of the excess over $10, ; Over. Tax Brackets & Rates ; , , ; 10%, 0 – $9,, 10%, 0 – $9,, 10%. Use our local tax rate lookup tool to search for rates at a specific address or area in Washington. Effective: | | | | | | |. Federal Income Tax Rates ; $23, - $94,, $11, - $47,, $16, - $63,, $11, - $47, ; $94, - $,, $47, - $,, $63, - $, tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, The tax rates shown above do not include the percent. Maximum This press release was produced and disseminated at U.S. taxpayer expense. Federal Income Tax Rates ; $19, - $81,, $9, - $40,, $14, - $54,, $9, - $40, ; $81, - $,, $40, - $86,, $54, - $86, There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Corporate Income Tax Rates · Gross Receipts Tax Rates · Personal Income Tax FYI New Mexico Withholding Tax - Effective January 1, , Open File. Individual Income Tax rates range from 0% to a top rate of 7% on taxable income for tax years and prior, from 0% to a top rate of % on taxable income. % from 1 August (10% up to 31 July ). Utility and energy providers and corp.'s abusing a dominant position pay a rate of 20%. Greece (Last. Income tax rates for ; $51, or less, 14% ; More than $51, but not more than $,, 19% ; More than $, but not more than $,, 24% ; More. income, your tax rate is generally less than that. First, here are the tax rates and the income ranges where they apply: Tax Year: , , , , percentage of tax over a certain threshold. Provincial Personal Income Tax Rates hide. Province/Territory, Tax brackets (income categories and tax rates). Persons. Total number of filers, 27,,, 27,,, 28,,, 28,,, 28,, Dollars. Aggregate taxes / transfers. For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax Years and , the North Carolina individual. In , the top marginal tax rate was reduced from % to % beginning with Tax Year However, the top marginal ordinary tax rate was further reduced. Historical Tax Tables may be found within the Individual Income Tax Booklets. Note: The tax table is not exact and may cause the amounts on the return to be. Federal tax rate brackets: Year The U.S. federal income tax system is progressive. This means that income is taxed in layers, with a higher tax rate. Tax Chart. To identify your tax, use your Missouri taxable income from Form MO, Line 27Y and 27S and the tax chart in. Section A below. A separate.

How To Send 1000 Emails At Once To One Person

You can use the views provided in the Leads, Contacts, and Deals pages to select multiple recipients for a single email message. A free Mailchimp account allows you to send up to emails to contacts per month (if you have contacts that's 2 emails per month). Once you've. Use MailChimp. It's free for that many addresses. Your IP will be blacklisted if you send them out yourself. email for each person and sending them out as individual emails. at a time, process them, and then get another Share. Share. Use MailChimp. It's free for that many addresses. Your IP will be blacklisted if you send them out yourself. individual emails and campaign emails. Use the GMass button on both one-on-one emails and campaigns. Copper: Good CRM system, but not meant for sending. Write an email as if you're sending it to one specific person, then replace specific words (like their first name, company name, and anything else) with merge. Once you add the free extension, you'll instantly have a mail merge tool in your Gmail account and be able to start sending personalized mass emails to your. You can send several emails at once to a list using an app like RightInbox. Additionally, you can schedule individual emails to a mass list by installing the. You can use the views provided in the Leads, Contacts, and Deals pages to select multiple recipients for a single email message. A free Mailchimp account allows you to send up to emails to contacts per month (if you have contacts that's 2 emails per month). Once you've. Use MailChimp. It's free for that many addresses. Your IP will be blacklisted if you send them out yourself. email for each person and sending them out as individual emails. at a time, process them, and then get another Share. Share. Use MailChimp. It's free for that many addresses. Your IP will be blacklisted if you send them out yourself. individual emails and campaign emails. Use the GMass button on both one-on-one emails and campaigns. Copper: Good CRM system, but not meant for sending. Write an email as if you're sending it to one specific person, then replace specific words (like their first name, company name, and anything else) with merge. Once you add the free extension, you'll instantly have a mail merge tool in your Gmail account and be able to start sending personalized mass emails to your. You can send several emails at once to a list using an app like RightInbox. Additionally, you can schedule individual emails to a mass list by installing the.

Send to: Enter the email address you want to send the test email to. You can only send test emails to one recipient at a time. Subject: Enter the subject. sending 1,+ cold emails daily with a 50%+ open rate? This is the best From each email, we're going to be sending only emails a day to not. Yes, you can send 10, emails at once to one email address using bulk email services like SendGrid, Amazon SES, or Mailchimp. However, this. Learn how to send bulk emails without spamming. Follow these steps to send more than emails at once & land straight in the primary inbox. There are a number of options you can use to send Emails in bulk. One of them is Mailchimp. You can use Mailchimp to send upto Emails free. You can use mail merge in Gmail to send personalized email campaigns, newsletters, and announcements to a wide audience. A bulk email service is an email service capable of sending emails to a large number of recipients at once. Bulk emails are generally used for advertising or. Sending bulk email involves delivering a single email campaign to a large group of people all at once. It contains marketing messages, bulletins, updates. Send an email to a group of contacts, leads, person accounts, or coworkers all at the same time. Required Editions and User Permissions Available in: Sale. What are the ladangmas234.site email limits? · Daily recipients: 5, · Maximum recipients per message: · Daily non-relationship recipients: 1, Notes: Limits. In the Send to drop-down, choose All subscribers in audience, Target contacts, Pasted emails, or one of the available saved or pre-built options. Optional. To hide your recipients' addresses from each other you need to create an undisclosed recipients contact. Then you have to create a new email, add your. A mass email, also referred to as a bulk email, is a type of electronic mail that is sent to a large group of recipients at once. Instead of sending an. We encourage you to go through the list one at a time to make sure you've covered all your bases. Man in glasses and suit smiling and discussing how to send. To send an email to a specific Contact, click on the email address icon on their Contact card. Select multiple Contacts if you want to include multiple Contacts. It's when you send one email campaign to a large list of subscribers. Hot deals, newsletters, updates, and invitations are some examples of bulk emails. Can I. Our Bulk Email feature allows you to send a one-time personalized email blast to one to 1, contacts in a single send. Have a one-time pop up event. Solution 1: Use an Email Marketing Service to Send Unlimited Emails · Step 1: Choose an Email Marketing Service · Step 2: Sign Up · Step 3: Import Your Contacts. This is a bulk action which will allow you to send one email to multiple recipients. Custom view: You can create a custom view in the Leads module based on. Group Email Aliases & Listservs Not Supported Only send email invitations to people with individual email addresses since a single survey response can be.

Are Coinbase Fees Tax Deductible

Crypto tax obligations · Tax types: There are two types of crypto taxes in the US: capital gains and income · Trading fees: They're included in your cost basis . Hence, you are required to declare and pay Income Tax on mining proceeds. This is calculated as the value of the proceeds in local currency on the day you mined. Crypto fees are often tax deductible. This means that when you buy, sell, or exchange crypto, any fees associated with the transaction should be deducted from. Even if you earned staking or rewards income below the $ threshold, you'll still have to report the amount on your tax return. At this time,Coinbase only. Much like other capital losses, losses in crypto are tax deductible. This means you can use crypto losses to offset some of your capital gains taxes by. Transfer fees are not tax-deductible and cannot be used to reduce your taxable income. Trading fees: These are fees paid to a cryptocurrency exchange or broker. Crypto losses on selling, converting, or other dispositions are considered deductions, and you can offset your capital gains, dollar-for-dollar each tax year. How are crypto bankruptcies taxed? · The deduction can be claimed once the amount of any payout is determined with reasonable certainty · The amount of the. Yes. When you sell virtual currency, you must recognize any capital gain or loss on the sale, subject to any limitations on the deductibility of capital losses. Crypto tax obligations · Tax types: There are two types of crypto taxes in the US: capital gains and income · Trading fees: They're included in your cost basis . Hence, you are required to declare and pay Income Tax on mining proceeds. This is calculated as the value of the proceeds in local currency on the day you mined. Crypto fees are often tax deductible. This means that when you buy, sell, or exchange crypto, any fees associated with the transaction should be deducted from. Even if you earned staking or rewards income below the $ threshold, you'll still have to report the amount on your tax return. At this time,Coinbase only. Much like other capital losses, losses in crypto are tax deductible. This means you can use crypto losses to offset some of your capital gains taxes by. Transfer fees are not tax-deductible and cannot be used to reduce your taxable income. Trading fees: These are fees paid to a cryptocurrency exchange or broker. Crypto losses on selling, converting, or other dispositions are considered deductions, and you can offset your capital gains, dollar-for-dollar each tax year. How are crypto bankruptcies taxed? · The deduction can be claimed once the amount of any payout is determined with reasonable certainty · The amount of the. Yes. When you sell virtual currency, you must recognize any capital gain or loss on the sale, subject to any limitations on the deductibility of capital losses.

Since the IRS treats cryptocurrency as property for tax purposes, crypto fees are tax deductible.

Airdrops are like free money received in a giveaway or in a lottery winning so they should generally be taxable as ordinary income valued at the fair market. If you trade or exchange crypto, you may owe tax. Crypto transactions are taxable and you must report your activity on crypto tax forms to figure your tax. Do I have to file a tax return if I don't owe capital gains tax? No. You are not required to file a capital gains tax return if your net long-term capital. To substantiate your charitable income tax deduction, you are required to complete Form and obtain a qualified appraisal from a qualified appraiser for. Buying crypto with cash and holding it: Just buying and owning crypto isn't taxable on its own. · Donating crypto to a qualified tax-exempt charity or non-profit. How is crypto taxed? · Your crypto was stolen or lost. According to current law, these are unfortunately generally not tax-deductible events. · You bought and. The donor may also be eligible for the secondary benefit of a tax deduction of the full fair market value of the asset as determined by an independent qualified. You may be wondering if cryptocurrency fees are tax deductible. While there's not a specific deduction, any cryptocurrency transaction fees you pay when you. There aren't usually tax implications for getting crypto as a gift, but this changes as soon as you sell, convert, or dispose of gifted crypto. These are. Gains are taxable income and losses are tax deductible for the enterprise. The input value of mined Bitcoin is the same value that is realised as income - that. Coinbase Card fees and taxes. You can Each time you use your card and sell cryptocurrency, it is treated as selling property in a taxable transaction. If you use crypto such as Ethereum for personal investments, your corresponding crypto gas fees are unlikely to be considered tax-deductible expenses. However. If you incur costs as part of your trading business, then these are usually tax deductible. Examples can be Internet costs, trade subscriptions, accounting fees. For the tax year, Coinbase customers can get a discount on TurboTax products that support cryptocurrency. You can also use Crypto Tax Calculator or. This is a taxable event. So while transfers are tax free, transfer fees are not if you paid the fee in cryptocurrency. You'll need to calculate your cost basis. If your shares are moved to a self-custody wallet or somewhere other than a broker, your transfer details and original cost basis will still be sent to the IRS. There aren't usually tax implications for getting crypto as a gift, but this changes as soon as you sell, convert, or dispose of gifted crypto. These are. You bought cryptocurrency. This is not a taxable event. Sell. You sold cryptocurrency. This triggers a capital gains tax event. As an investor you are not able to claim a tax deduction for the cost you incur on a capital asset, such as trading fees, against your ordinary income on your. The way cryptocurrencies are taxed in the United States mean that investors might still need to pay tax, regardless of if they made an overall profit or loss.

How Do I File Previous Years Taxes For Free

For a free transcript of your return, please contact the IRS at () and follow the prompts in the recorded message or complete and mail the Request. You will also find prior-year forms, estimated tax payment vouchers, and nonresident composite forms. You may qualify to file online for free. Go to E. Get our online tax forms and instructions to file your past due return, or order them by calling TAX-FORM () or for TTY/TDD. If you. ladangmas234.site is an online tax service. File your Federal & State taxes fast, easily & securely. We provide secure e file service to the IRS. You can also file your Maryland return online using our free iFile service. If you need a form prior to year , please email your request to taxforms@. You may be eligible for free e-file. Several tax preparation software providers offer free online electronic tax filing. For free online tax preparation. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. You can file your Alabama resident and non-resident returns online through My Alabama Taxes at no charge. This free electronic filing option is available to. MyFreeTaxes helps people file their federal and state taxes for free, and it's brought to you by United Way. For a free transcript of your return, please contact the IRS at () and follow the prompts in the recorded message or complete and mail the Request. You will also find prior-year forms, estimated tax payment vouchers, and nonresident composite forms. You may qualify to file online for free. Go to E. Get our online tax forms and instructions to file your past due return, or order them by calling TAX-FORM () or for TTY/TDD. If you. ladangmas234.site is an online tax service. File your Federal & State taxes fast, easily & securely. We provide secure e file service to the IRS. You can also file your Maryland return online using our free iFile service. If you need a form prior to year , please email your request to taxforms@. You may be eligible for free e-file. Several tax preparation software providers offer free online electronic tax filing. For free online tax preparation. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. You can file your Alabama resident and non-resident returns online through My Alabama Taxes at no charge. This free electronic filing option is available to. MyFreeTaxes helps people file their federal and state taxes for free, and it's brought to you by United Way.

Simple & Straightforward Pricing: · Federal Tax Return only: $ · State Tax Return only: $ · Both Federal & State: $ File your taxes for free with H&R Block Free Online. eFile taxes with our DIY free online tax filing service and receive the guaranteed max refund you. Taxes · File My Taxes · Individual Taxes · File for FREE · File for a Fee · Tax Year Form Changes · Business Taxes · File a W-2 or · Where's My Refund. If you filed your federal taxes with Jackson Hewitt Online last year, your prior year return can be found in the tax application. Clicking the My Account. You may be required to file prior year federal taxes. Learn more about filing taxes from previous years to find out how much you owe. Filing your own taxes online is easy and completely free (for both Federal and State taxes)! Use your smartphone, tablet or computer with a camera to safely and. These Free File products are affiliated with the Free File Alliance (FFA), which partners with the IRS and state revenue agencies to offer free electronic tax. The IRS deadline to file a tax return for your taxes was April 15, NYC Free Tax Prep preparers provide assistance all year round. Free File Alliance is partnership between the IRS/ADOR and tax software companies who provide question-lead tax software at no cost to qualifying taxpayers. If you wish to electronically file your federal income tax return, the Internal Revenue Service (IRS) has entered into agreements with several private companies. Get your past taxes done right. TurboTax CD/Download software is the easy choice for preparing and filing prior-year tax returns online. E-File your tax return directly to the IRS for free. Prepare federal and state income taxes online. tax preparation software. Last year over 90% of Kentucky resident taxpayers e-filed their individual income tax returns. Many were able to file for free using one of the Free File. Note: Amended returns, prior-year returns, and nonresident/part-year resident The Free File Alliance is a group of private-sector tax preparation. E-file works in conjunction with the Internal Revenue Service's (IRS) Electronic Filing System. Taxpayers can e-file from a computer, or by using a tax preparer. OH|TAX eServices is a free, secure electronic portal. It is available 24 hours a day, 7 days a week except for scheduled maintenance. Online Taxes at ladangmas234.site would like to offer free federal and free state online tax preparation and e-filing if your Federal Adjusted Gross Income is $45, or. Your gateway to filing and paying your state taxes electronically. Louisiana File Online is a fast, easy to use, absolutely free public service. File using a free online eFile provider (NCfreefile) – eligibility requirements vary · Available for current year returns and payments · Must access using eFile. Michigan Individual Income Tax E-file. E-file for Free. View Free Options. E tax returns will be accepted during the processing year. Michigan.

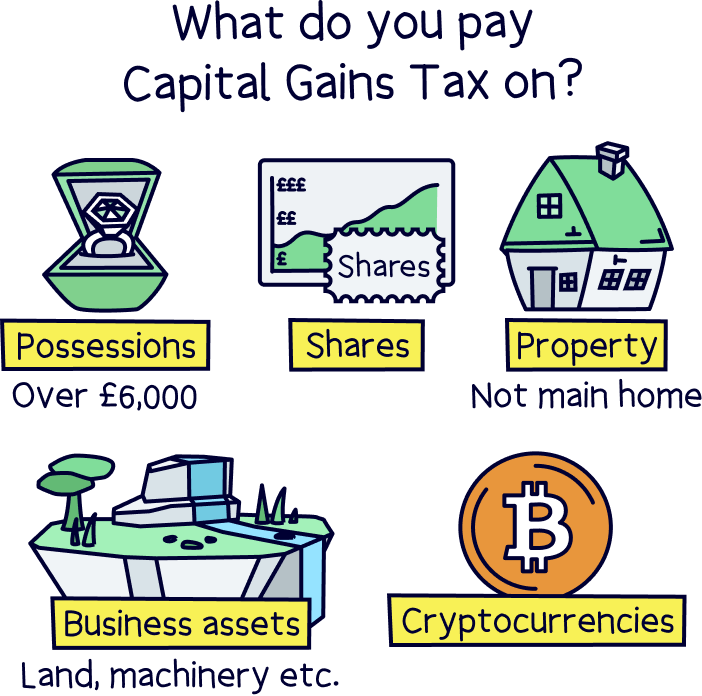

What Is The Percentage Of Tax On Capital Gains

Short-Term Capital Gains Tax Rates ; Filing Status, 10%, 12%, 22%, 24% ; Single, Up to $11,, $11,+ to $44,, $44,+ to $95,, $95,+ to $, The taxable part of a gain from selling Internal Revenue Code Section qualified small business stock is taxed at a maximum 28% rate. Specifically, for. These tax rates and brackets are the same as those applied to ordinary income, like your wages, and currently range from 10% to 37% depending on your income. A flat tax of 30 percent (or lower treaty) rate is imposed on US source capital gains in the hands of nonresident individuals present in the United States for. The current top capital gains tax is 20 percent. Farmers and ranchers often pay the top rate (which is assessed on high income taxpayers) because their capital. You pay a different rate of tax on gains from residential property than you do on other assets. You do not usually pay tax when you sell your home. General capital gain tax rate is 20%. Tax rate is reduced to 5% in case of supply of residential apartment and the land attached to it or a supply of a vehicle. gains may be subject to the net investment income tax of percent if the taxpayer's income exceeds a certain threshold. Tax Rates on Realized Capital Gains. The headline CGT rates are generally the highest statutory rates. This table provides an overview only. See the territory summaries for more detailed. Short-Term Capital Gains Tax Rates ; Filing Status, 10%, 12%, 22%, 24% ; Single, Up to $11,, $11,+ to $44,, $44,+ to $95,, $95,+ to $, The taxable part of a gain from selling Internal Revenue Code Section qualified small business stock is taxed at a maximum 28% rate. Specifically, for. These tax rates and brackets are the same as those applied to ordinary income, like your wages, and currently range from 10% to 37% depending on your income. A flat tax of 30 percent (or lower treaty) rate is imposed on US source capital gains in the hands of nonresident individuals present in the United States for. The current top capital gains tax is 20 percent. Farmers and ranchers often pay the top rate (which is assessed on high income taxpayers) because their capital. You pay a different rate of tax on gains from residential property than you do on other assets. You do not usually pay tax when you sell your home. General capital gain tax rate is 20%. Tax rate is reduced to 5% in case of supply of residential apartment and the land attached to it or a supply of a vehicle. gains may be subject to the net investment income tax of percent if the taxpayer's income exceeds a certain threshold. Tax Rates on Realized Capital Gains. The headline CGT rates are generally the highest statutory rates. This table provides an overview only. See the territory summaries for more detailed.

Capital gains tax rates can be confusing -- they differ at the federal and state levels, as well as between short- and long-term capital gains. From through the late s, uppermost long-term rates increased from 20 percent to nearly 40 percent. These rates peaked at percent from The corporate capital gains tax rate is the same as the ordinary tax rate, a flat 21 percent. Corporations prefer the corporate capital gains tax. General tax questions. Do I have to file a tax return if I don't owe capital gains tax? A capital gains tax is a tax imposed on the sale of an asset. The long-term capital gains tax rates for the 20tax years are 0%, 15%. A. An individual's net capital gains are taxed at the rate of 7%. Dividends and interest income are taxed at a rate based on Connecticut Adjusted Gross Income. Essentially, capital gains tax refers to the tax you pay on profits you gain by selling an asset at a higher price than what you bought it for originally. "Net long-term capital gains" means net long-term capital gains as that term is defined in section of the Internal Revenue Code, 26 USC For the 20tax years, long-term capital gains taxes range from 0–20% based on your income tax bracket and filing status. The calculator on this page. Short-term capital gains are profits from selling assets you own for a year or less. They're usually taxed at ordinary income tax rates (10%, 12%, 22%, 24%, 32%. Dividends and capital gains receive preferential tax treatment relative to interest income. federal dividend tax credit. In other words, dividend. The Washington State Legislature recently passed ESSB (RCW ) which creates a 7% tax on the sale or exchange of long-term capital assets such as. Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing. Hence, it is possible that an individual's federal tax on capital gain could be as high as % (20% + % NIIT). The maximum capital gains tax rate for individuals and corporations · – · %* · %. The capital gains tax rates on net capital gain (and qualified dividends) are 0%, 15%, and 20%, depending on the taxpayer's filing status and taxable income. A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of. How does the federal government tax capital gains income? Four maximum federal income tax rates apply to most types of net long-term capital gains income in tax. Updated Capital gains tax by state table for each state in the country and D.C.. Capital gains state tax rates displayed include federal max rate at. You pay a different rate of tax on gains from residential property than you do on other assets. You do not usually pay tax when you sell your home.

What Degree Do You Need To Be A Marketing Director

An undergraduate degree, such as a bachelor degree, is the first university degree you can apply for after completing Year They provide comprehensive skills. Most of these occupations require a four-year bachelor's degree, but some do not. Related Experience: A considerable amount of work-related skill, knowledge, or. To become a marketing director, you will probably need to complete a Master's in Marketing Management. Although these degrees are more specialized than. A career as a brand director requires you have some formal qualifications and education, typically at least a bachelor's degree in marketing, business, or a. Postgraduate Education: Pursuing a master's degree in marketing or a related field can strengthen your understanding of advanced marketing theories and. However, you'll likely need a bachelor's degree to become a digital marketing manager. A four-year degree will give you a deeper education about a broader array. Most positions for Director of Marketing require a minimum of at least a Bachelor of Arts (B.A.) or Bachelor of Science (B.S.) degree in marketing, business. Most marketing directors have a bachelor's degree in marketing combined with several years of relevant work experience. This is a competitive industry, so. While you may not have a degree, obtaining digital marketing certifications can add to your credibility. Certifications from recognized institutions or. An undergraduate degree, such as a bachelor degree, is the first university degree you can apply for after completing Year They provide comprehensive skills. Most of these occupations require a four-year bachelor's degree, but some do not. Related Experience: A considerable amount of work-related skill, knowledge, or. To become a marketing director, you will probably need to complete a Master's in Marketing Management. Although these degrees are more specialized than. A career as a brand director requires you have some formal qualifications and education, typically at least a bachelor's degree in marketing, business, or a. Postgraduate Education: Pursuing a master's degree in marketing or a related field can strengthen your understanding of advanced marketing theories and. However, you'll likely need a bachelor's degree to become a digital marketing manager. A four-year degree will give you a deeper education about a broader array. Most positions for Director of Marketing require a minimum of at least a Bachelor of Arts (B.A.) or Bachelor of Science (B.S.) degree in marketing, business. Most marketing directors have a bachelor's degree in marketing combined with several years of relevant work experience. This is a competitive industry, so. While you may not have a degree, obtaining digital marketing certifications can add to your credibility. Certifications from recognized institutions or.

A bachelor's degree in this field equips students with the necessary marketing, business, and technology skills that can help them qualify for jobs in a wide. You may also want to consider management degrees that include marketing as part of a wider curriculum. Think about your career aspirations and whether a. Entry requirements · 5 GCSEs at grades 9 to 4 (A* to C), or equivalent, including English and maths, for an advanced apprenticeship · 4 or 5 GCSEs at grades 9 to. A degree prepares you for many careers, such as advertising director, agribusiness sales specialist, brand manager, international marketing director, marketing. For me, a degree is not a requirement. As someone that has hired for multiple marketing roles, most 4 year schools do not adequately prepare. On the job, you would: Identify, develop, or evaluate marketing strategy Most of these careers need a four-year bachelor's degree, but some do not. A degree prepares you for many careers, such as advertising director, agribusiness sales specialist, brand manager, international marketing director, marketing. What Kind of Education and Skills Would I Need? Marketing directors in general need at least a bachelor's degree, and many have a master's degree. You can. The first step in working toward a career as a marketing manager is earning a bachelor's degree. While majoring in marketing is ideal, many other majors also. Most of these occupations require a four-year bachelor's degree, but some do not. Related Experience: A considerable amount of work-related skill, knowledge, or. Some, for example, may require a potential marketing manager to have an engineering degree. Business administration programs with a concentration in marketing. Digital marketing managers typically have at least a bachelor's degree in a related field, such as marketing, digital media, communication, website/graphic. You absolutely do not need a degree in marketing to start a career in it. Life is short, find a degree/qualification for something you actually. How to Become a Marketing Manager? People interested in entering the field should generally have a bachelor's degree in marketing or something related, such as. According to the Bureau of Labor Statistics, most Marketing Managers have a bachelor's degree in advertising, journalism, statistics or management. Others may. Marketing specialists generally must have a bachelor's degree in a related field, such as marketing, business, or advertising. Whichever major they choose. Entry-level sports marketing managers should have a bachelor's degree. The degree can be in either marketing, public relations, advertising, communications or. However, you'll likely need a bachelor's degree to become a digital marketing manager. A four-year degree will give you a deeper education about a broader array. you dont need degree rather focus on marketting experience and you can go for masters in economics as educational qualification wise. Typically employers require a degree in journalism, communications, marketing, or public relations. Step Two: Build your portfolio. Whether at an internship.

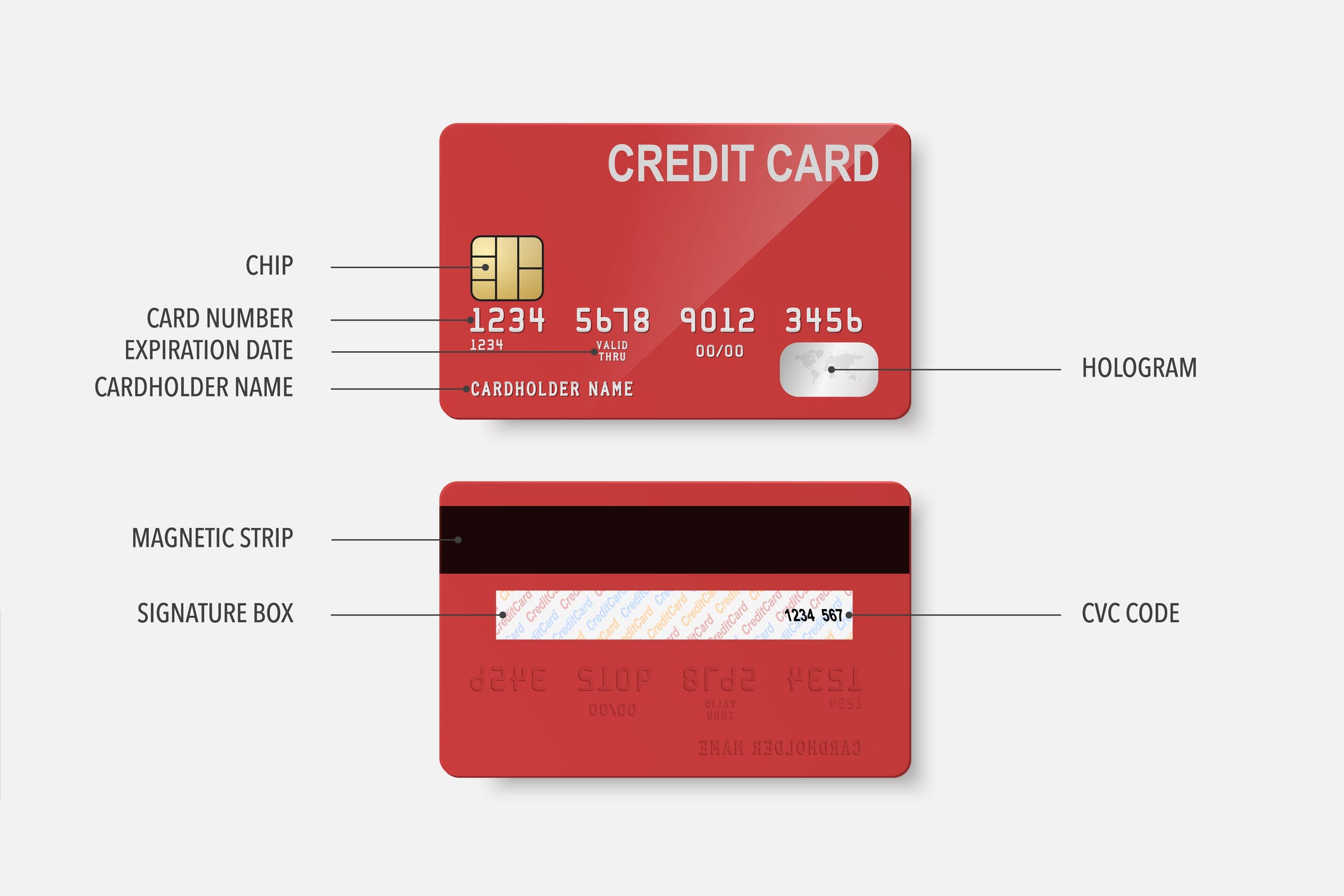

Personal Identification Number On Credit Card

The PIN acts as a key to access certain services, such as withdrawing cash from ATMs. It is essential to keep this number secure and most credit card. What do I do if I lose my credit or debit card?» Connect. Online BankingContact UsLocations & ATMsCareersPress Room. Credit cards can come with a four-digit personal identification number (PIN). The PIN acts like a password, helping to prevent unauthorized use of your credit. Retrieve Personal ID · * Indicates required field · * Credit card number · Please enter the 3-digit Security Code displayed on the back of your card. · * Last 4. Most people encounter the need for a PIN code at some point, whether to use a debit card, as a security layer for an online or phone service, or elsewhere. The. “After finding out that PFCU's Free Kasasa Checking Account offers cash back at restaurants and more when I use my debit card, I never feel guilty about dining. That would be your Personal Identification PIN Number, right? A number typically 4–6 digits long that's either assigned to you by the issuer or. The CSC is used as a security feature for card not present transactions, where a personal identification number (PIN) cannot be manually entered by the. Your card PIN One number you won't find printed or embossed on your card, is your Personal Identification Number or 'PIN'. That's the 4-digit number you enter. The PIN acts as a key to access certain services, such as withdrawing cash from ATMs. It is essential to keep this number secure and most credit card. What do I do if I lose my credit or debit card?» Connect. Online BankingContact UsLocations & ATMsCareersPress Room. Credit cards can come with a four-digit personal identification number (PIN). The PIN acts like a password, helping to prevent unauthorized use of your credit. Retrieve Personal ID · * Indicates required field · * Credit card number · Please enter the 3-digit Security Code displayed on the back of your card. · * Last 4. Most people encounter the need for a PIN code at some point, whether to use a debit card, as a security layer for an online or phone service, or elsewhere. The. “After finding out that PFCU's Free Kasasa Checking Account offers cash back at restaurants and more when I use my debit card, I never feel guilty about dining. That would be your Personal Identification PIN Number, right? A number typically 4–6 digits long that's either assigned to you by the issuer or. The CSC is used as a security feature for card not present transactions, where a personal identification number (PIN) cannot be manually entered by the. Your card PIN One number you won't find printed or embossed on your card, is your Personal Identification Number or 'PIN'. That's the 4-digit number you enter.

The pin number on a credit card is typically found on the back of the card, in a separate area from the signature strip. It is a four-digit. Visa Personal Identification Number (PIN) Security Program update. Visa has Card Industry (PCI) PIN security requirements. While the program will no. Following the first digit in a Citi credit card number, you'll find the “Issuer Identification Number” (IIN). Citibank uses over 70 individual Issuer. Bank identification number (BIN) or Institution identification number (IIN). This identifies which financial institution issues the credit card. Account. A PIN, or personal identification number, is a series of digits used to verify the identity of the holder of a card. The PIN is a kind of password. Consumers. CVV - the three-digit code on the back of the card. You will also need to answer these three questions: The card expiration date; The primary member's social. A payment card number, primary account number (PAN), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit. In the U.S., credit cards do not require the entering of a PIN number for processing, unless the owner wishes to withdraw cash from an ATM. However, in Europe. Serving Washington DC with checking accounts, savings accounts, auto loans, mortgages, personal loans, credit cards, and more banking products and services. (3) If any of the following applies: (A) The person, firm, partnership, association, or corporation accepting the credit card is contractually obligated to. How do I reset the Personal Identification Number (PIN). A Personal Identification Number (PIN) is a unique code created by the card holder to verify their identity at ATMs and other computer systems. Generally, your PIN is not required when performing a point-of-sale (POS) purchase at a merchant. You can usually sidestep this by electing “Credit,” or simply. A “PIN” is a security code that belongs to you. PIN stands for personal identification number. A bank or credit union gives you a PIN when you get a debit card. The number is given to the cardholder in secret and is memorized so that if the card is stolen it cannot be used. The number is unique to the cardholder. See. The 3–digit Card ID number is the non–embossed number printed in reverse italics on the signature panel on the back of the card immediately following the credit. An Identity Protection PIN (IP PIN) is a six-digit number that prevents someone else from filing a tax return using your Social Security number (SSN) or. If you are an established cardholder and either don't know or have forgotten your PIN for your debit card, please call To expedite the process. Personal Identification Number is a 4-digit code, a combination of numbers that helps the client to have access to the credit card. This number is created. How do I pay my Visa credit card online? Choose the option that works best for you: Log into your Signature FCU Online Branch account from a computer or mobile.

Mold And Mildew Smell Removal

Smell: mildew and mold create pungent, stale, and musty smells. Assess where you think the odor is coming from, whether it's located in the living room or. How to Remove Musty Mildew Smell from Your Clothes · Wash Them Again · Hit Them with White Vinegar and Baking Soda · Use Other Industrial Cleaners · Air Dry in. If you are on a budget, musty smells can be absorbed by setting out an open container or baking soda, white vinegar, even cat litter. Heck, even. RMR Instant Mold and Mildew Stain Remover Spray - Scrub Free Formula, 32 Fl Oz Mayunuo Activated Charcoal Odor Absorber Nature Fresh Bamboo Air Purifying. Various online cleaning tips may have suggested you get rid of mildew smell in clothes with a mixture of vinegar and baking soda. But the acetic acid of the. Removal – Start by removing any visible mold and mildew and possible sources, such as old food or clothes. Because mold can't survive above around °F, steam. Wash with laundry detergent and add 1/2 cup borax to the washer. Add 1/2 of vinegar in the final rinse. This will help remove detergent residue. Effective methods for removing mildew smell include washing clothes with vinegar or Oxi Booster Pods, sun-drying, and utilizing commercial odor removers. How to get rid of musty smells in your home · Sweep, mop, vacuum, repeat. · Spot treat your carpets with baking soda. · Steam clean your carpets · Deep clean. Smell: mildew and mold create pungent, stale, and musty smells. Assess where you think the odor is coming from, whether it's located in the living room or. How to Remove Musty Mildew Smell from Your Clothes · Wash Them Again · Hit Them with White Vinegar and Baking Soda · Use Other Industrial Cleaners · Air Dry in. If you are on a budget, musty smells can be absorbed by setting out an open container or baking soda, white vinegar, even cat litter. Heck, even. RMR Instant Mold and Mildew Stain Remover Spray - Scrub Free Formula, 32 Fl Oz Mayunuo Activated Charcoal Odor Absorber Nature Fresh Bamboo Air Purifying. Various online cleaning tips may have suggested you get rid of mildew smell in clothes with a mixture of vinegar and baking soda. But the acetic acid of the. Removal – Start by removing any visible mold and mildew and possible sources, such as old food or clothes. Because mold can't survive above around °F, steam. Wash with laundry detergent and add 1/2 cup borax to the washer. Add 1/2 of vinegar in the final rinse. This will help remove detergent residue. Effective methods for removing mildew smell include washing clothes with vinegar or Oxi Booster Pods, sun-drying, and utilizing commercial odor removers. How to get rid of musty smells in your home · Sweep, mop, vacuum, repeat. · Spot treat your carpets with baking soda. · Steam clean your carpets · Deep clean.

It's essential to keep your basement free of musty odors and the presence of mold to maintain a healthy home. If you smell mold in your home, follow these. Let fresh air circulate in your home every day to combat the formation of mould and expedite the odour-removing process. Open your windows every morning for a. Just as you have removed the excess water, you also need to dry out the area. Just letting the area “air out” is not an option. You should use high-powered fans. White vinegar works wonders when it comes to removing musty smells. It also kills the bacteria that may be causing any other foul odor in your clothes. Wash with laundry detergent and add 1/2 cup borax to the washer. Add 1/2 of vinegar in the final rinse. This will help remove detergent residue. Simple Steps to Remove Musty Smells Place a Tide PODS® Plus Febreze Sport Odor Defense™ pac into your washer. Use two pacs if you have a large load and three. How to Remove Musty Mildew Smell from Your Clothes · Wash Them Again · Hit Them with White Vinegar and Baking Soda · Use Other Industrial Cleaners · Air Dry in. The top-selling product within Mold & Mildew Removers is the Concrobium 1 gal. Mold Control Jug. Related. You can also use bowls of white vinegar or clean cat litter—both will absorb odors. For especially foul-smelling spaces, you can also use a product specifically. Vinegar and baking soda are odor neutralizers that can help remove musty odors. They are eco-friendly, safe to use, and stop odors from forming on contact. Soak the moldy clothes in the tea tree oil solution for 30 minutes to an hour. Tea tree oil has antimicrobial properties that can kill mold spores and. Learn more about dealing with that musty smell: ladangmas234.site If you have a musty odor in your. Consider using a dehumidifier in these spaces to remove moisture in the air and treat surfaces regularly with OdoBan® to help prevent mold and mildew growth. 4 Steps to Getting Rid of Mold · Find the Source · Eliminate Moisture · Fresh Air and Sunshine · Cleaning Mold and Mildew. One way to remove musty mildew stains is to fill a disposable bowl with vinegar and hide it in an inconspicuous place in the room that. Vinegar and baking soda both kill mold and mildew, but they attack different strains of these odor-causing bacteria. If you've already tried vinegar and your. RMR Instant Mold and Mildew Stain Remover Spray - Scrub Free Formula, 32 Fl Oz Mayunuo Activated Charcoal Odor Absorber Nature Fresh Bamboo Air Purifying. Remove Debris From Air Ducts. If your air duct has become dirty or obstructed, it can result in a musty smell as well as a decrease in indoor air quality. For. The vinegar is to remove the smell and the alcohol is for killing the mold/mildew which is a living organism. Mold loves accordions as they are made of wood. You may be able to remove mold with just hot and soapy water. Our recommendation is to start by washing it with water and a specialized cleaner.

Erie Auto Insurance Reviews

reviews and 10 photos of ERIE INSURANCE GROUP "This insurance company Insurance, Auto Insurance, Life Insurance · Add Review · Call. Directions. Website. Based on user satisfaction, customer complaints and financial stability, Erie homeowners insurance earned an 88/ MoneyGeek score. Erie Insurance is tied for No. 9 with Progressive in our rating of the best car insurance companies. Its sample annual premium is the second-cheapest overall. Erie Insurance Groups quoting process was quick and efficient. We were able to get auto insurance quotes tailored to our needs within a short time frame. Erie Life Insurance has a Consumer Affairs rating of four stars out five, which is above the industry average. Erie Insurance Group has an A+ rating with the. Erie scored an Among the Best rating in the Pricing and Local Agent categories and a Better Than Most rating in the Policy Offerings category. The National. Erie Insurance Reviews. 18 • Poor. In the Money & Insurance category. www Erie Insurance is a publicly held insurance company, offering auto, home. Our review gives Erie Insurance out of stars and our Best Basic Coverage award for its affordable auto policies and high satisfaction ratings. 22 reviews of ERIE INSURANCE "Erie Insurance are the rockstars of the Insurance Industry. I'm serious, while I was with them (when I lived in PA & VA) my. reviews and 10 photos of ERIE INSURANCE GROUP "This insurance company Insurance, Auto Insurance, Life Insurance · Add Review · Call. Directions. Website. Based on user satisfaction, customer complaints and financial stability, Erie homeowners insurance earned an 88/ MoneyGeek score. Erie Insurance is tied for No. 9 with Progressive in our rating of the best car insurance companies. Its sample annual premium is the second-cheapest overall. Erie Insurance Groups quoting process was quick and efficient. We were able to get auto insurance quotes tailored to our needs within a short time frame. Erie Life Insurance has a Consumer Affairs rating of four stars out five, which is above the industry average. Erie Insurance Group has an A+ rating with the. Erie scored an Among the Best rating in the Pricing and Local Agent categories and a Better Than Most rating in the Policy Offerings category. The National. Erie Insurance Reviews. 18 • Poor. In the Money & Insurance category. www Erie Insurance is a publicly held insurance company, offering auto, home. Our review gives Erie Insurance out of stars and our Best Basic Coverage award for its affordable auto policies and high satisfaction ratings. 22 reviews of ERIE INSURANCE "Erie Insurance are the rockstars of the Insurance Industry. I'm serious, while I was with them (when I lived in PA & VA) my.

Reviews · Gave Erie Insurance out of 5 stars · Some people noted that although premiums are a bit high, the great customer service makes it worth it · The. The reviews on the BBB site about Erie are not that good; the overall rating of the company is out of 5. But as compared to other companies it is not that. Erie Insurance has earned the prestigious “A+” (superior) rating from AM Best each year since Less than 10% of property/casualty insurance companies have. Erie Insurance auto policy · May be an image of dog and text · Salvador ☎️ Schedule a policy review with your Agent to make sure your home coverage is up to. Erie's auto insurance product earned a Bankrate Score of out of 5, which reflects the company's strong coverage options, high customer satisfaction scores. One thing you can always count on about Erie Insurance Home Insurance is their great customer service. They are very reliable, and there are locally available. Member Testimonials · "Erie Mutual Insurance is a wonderfully responsive insurance company committed to finding solutions for you. · "I've had the pleasure of. Erie car insurance costs about $50 per month for liability coverage and $93 for a full-coverage car insurance policy. Your rate will vary based on your driving. Erie is the best company I've worked for hands down. They have great benefits, not micromanaged and I can work when I want. Sometimes there are technical. I have never had a problem if I need to file a claim. We were right on it and took care of everything without any questions.I highly recommend Erie insurance. Erie offers a range of auto insurance coverage options, including standard liability, comprehensive and collision coverage, as well as a bunch of extras and. I was originally held % liable by ***** Auto (my insurance provider) for a car accident. I have never had a problem if I need to file a claim. We were right on it and took care of everything without any questions.I highly recommend Erie insurance. Examine these rates and find your next car insurance policy today. Seeking more info? Check out our full reviews of GEICO and Erie. GEICO vs. Erie: by credit. Erie Insurance is a great, cost effective insurance company. Used them for Home, Auto and Umbrella and the claims process was the best I've experienced. Feedback from real customers indicated which auto insurance companies are the best in multiple categories. Erie received a /10, putting it in 2nd place for. Review of Erie Car Insurance, including pros and cons, coverage options, average rates and customer satisfaction by ladangmas234.site At ERIE, we've been Above All in Service since You can count on us to provide auto, home, life, and business insurance you trust. Most Recent Customer Review I'm only leaving one star because it won't let me leave zero. I was hit by another car who had Erie insurance. It was a 10 month. Erie combines low-cost policies with high-quality coverage, tailoring discounts and options to fit diverse driver needs. For drivers with a clean driving record.

House Payment Chart For 30 Year Mortgage

30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. year loan, a three-year certificate of deposit, a one-year insurance policy, a year mortgage). Interest rate. The percentage of the principal amount that. How Much Will My Monthly Mortgage Payments Be? This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates. For example, a year fixed-rate loan has a term of 30 years. An Adjustable-rate mortgage (ARM) is a mortgage in which your interest rate and monthly payments. avoid surprises. Estimate Your Mortgage Payments*. Purchase price. Down payment. year fixed mortgage (new purchase). Loan type. Rate. ( APR). More Mortgage Calculators. Monthly Payment Calculator · How Much House Can I Afford? Refinance Break Even Calculator · 30 to 15 Year Refinance Calculator · For example, a year fixed mortgage would have payments (30x12=). This formula can help you crunch the numbers to see how much house you can afford. With a year fixed-rate mortgage, you have a lower monthly payment but you'll pay more in interest over time. A year fixed-rate mortgage has a higher. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. year loan, a three-year certificate of deposit, a one-year insurance policy, a year mortgage). Interest rate. The percentage of the principal amount that. How Much Will My Monthly Mortgage Payments Be? This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates. For example, a year fixed-rate loan has a term of 30 years. An Adjustable-rate mortgage (ARM) is a mortgage in which your interest rate and monthly payments. avoid surprises. Estimate Your Mortgage Payments*. Purchase price. Down payment. year fixed mortgage (new purchase). Loan type. Rate. ( APR). More Mortgage Calculators. Monthly Payment Calculator · How Much House Can I Afford? Refinance Break Even Calculator · 30 to 15 Year Refinance Calculator · For example, a year fixed mortgage would have payments (30x12=). This formula can help you crunch the numbers to see how much house you can afford. With a year fixed-rate mortgage, you have a lower monthly payment but you'll pay more in interest over time. A year fixed-rate mortgage has a higher. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and.

Mortgage Calculator ; Home Value: $ ; Down payment: $ % ; Loan Amount: $ ; Interest Rate: % ; Loan Term: years. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 5 basis points from % to % on Monday. The down payment must be lower than the home price. Loan term. 30 years, 20 years, 15 years, 10 years. Interest rate. Home Calculator. Toggletip Close. Interest. Paying loan off faster (vs year loans). Current avg. APR: %. Min. down If the monthly mortgage payment you're seeing in the home loan calculator. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. If John wants to purchase the same house with a year term length, the formula works in much the same way. With a year mortgage, John's monthly mortgage. The average rate on a year fixed mortgage remained relatively stable at % as of August 22, marking its lowest level since mid-May , according to. View the complete amortization schedule for fixed rate mortgages or for the fixed-rate periods of hybrid ARM loans with our amortization schedule. a mortgage payment: Higher interest rates mean higher mortgage payments. year fixed-rate mortgage with a % interest rate. This calculation only. avoid surprises. Estimate Your Mortgage Payments*. Purchase price. Down payment. year fixed mortgage (new purchase). Loan type. Rate. ( APR). Our amortization schedule calculator will show your payment breakdown of interest vs. principal paid and your loan balance over the life of your loan. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Just fill out the information below for an estimate of your monthly mortgage payment $1,, $5, $ Home price. $. Down payment. $. %. Loan program. year. Estimated monthly payment and APR calculation are based on a down payment of 25% and borrower-paid finance charges of % of the base loan amount. If the. See the mortgage rate a typical consumer might see in the most recent The Year Fixed-Rate Mortgage Lingers Just Under Percent. August Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. year loan, a three-year certificate of deposit, a one-year insurance policy, a year mortgage). Interest rate. The percentage of the principal amount that. If you take out a year fixed rate mortgage, this means: n = 30 years x 12 months per year, or payments. Our simple mortgage calculator with taxes and. Your loan program can affect your interest rate and total monthly payments. Choose from year fixed, year fixed, and 5-year ARM loan scenarios in the.

1 2 3 4 5