ladangmas234.site

News

Private Business Valuation

The three common methodologies used to value private businesses. Income Approach values a business or asset based on its expected future cash flow. One approach is to come up with an estimate of the equity value of the company, then use this to look up the size risk premium for your discount and cap rate. Private company valuation is a set of valuation methodologies used to determine the intrinsic value of a private company. For public companies, we can. In this article, we cover three main methods of business valuation: discounted cash flow, book value, and comparable company analysis. Our business valuation. A valuation will take into account a number of characteristics of the business such as its asset inventory or its cash flow when determining its true value. A. Ask a finance professor about the best business valuation method. The answer will be there are three approaches to choose from. Private company valuations are typically performed for three different reasons: transactions, compliance (financial or tax reporting), or litigation. A company with annual EBITDA of $1MM is generally worth between $2MM and $10MM. There are, of course, outliers where companies are worth more or less than this. Private company valuation is the process by which a private company is assessed for its current worth. Get Started - It's free! The three common methodologies used to value private businesses. Income Approach values a business or asset based on its expected future cash flow. One approach is to come up with an estimate of the equity value of the company, then use this to look up the size risk premium for your discount and cap rate. Private company valuation is a set of valuation methodologies used to determine the intrinsic value of a private company. For public companies, we can. In this article, we cover three main methods of business valuation: discounted cash flow, book value, and comparable company analysis. Our business valuation. A valuation will take into account a number of characteristics of the business such as its asset inventory or its cash flow when determining its true value. A. Ask a finance professor about the best business valuation method. The answer will be there are three approaches to choose from. Private company valuations are typically performed for three different reasons: transactions, compliance (financial or tax reporting), or litigation. A company with annual EBITDA of $1MM is generally worth between $2MM and $10MM. There are, of course, outliers where companies are worth more or less than this. Private company valuation is the process by which a private company is assessed for its current worth. Get Started - It's free!

While the same financial and valuation theory is used to value both public and private companies, there are distinct differences that appraisers and. Investors in public companies have a short-term time perspective, whereas owners of private companies have a long-term perspective. Small Business Valuation Methods · Price-To-Earnings Ratio (P/E) · Entry Cost Valuation · Asset Valuation · Market Comparison. A business valuation gives a company an absolute economic value. This final number can be reached in many ways, often with specific methods and formulas. Valuation methods for calculating Enterprise Value include, but are not limited to, discounted cash flow (DCF) analysis, using public company share prices, or. Your business's value is measured in profits. A company valuation is all about the money you make now and in the future. A buyer wants to know how much they can. The business must be valued by business valuation experts. Typically, they use one of two valuation approaches: the EBITDA Approach or the Asset Approach. A valuation approach commonly used by private equity and investment banking professionals, and the one we will focus on here, applies a multiple to Earnings. Determining the true value of a private company can be a difficult task, particularly if the relied-upon data is less-than-reliable. First, there are 3 different valuation approaches to value a business, the income, market, and asset approach. If your company had earnings of $2 per share, you would multiply it by 15 and would get a share price of $30 per share. If you own 10, shares, your equity. The standard method used within this industry is calculating a pro forma EBITDA and multiple forward assessment of risks to assume a reasonable investment. This article focuses on best practices for estimation of the WACC in the context of a private company valuation. Business valuation is a process and a set of procedures used to estimate the economic value of an owner's interest in a business. Here various valuation. In this tutorial, you'll learn how private companies are valued differently from public companies, including differences in the financial statements. Quickly build accurate and transparent comps with the world's largest source of deal multiples and private company valuations. BIZCOMPS - Main Street Private Company Transaction Comparables ; CONTACT US. Business Valuation Resources SW Columbia St, Suite Portland, OR Private companies face a unique set of challenges. Multiple rounds of financing can leave companies with a complicated and confusing capital structure, making. You'll need a private company valuation formula to determine the value of shares, ie, 5% or 10% of your business. A business valuation is an independent appraisal that assesses the worth of your company. This can be done in many ways, but it is commonly based on expected.

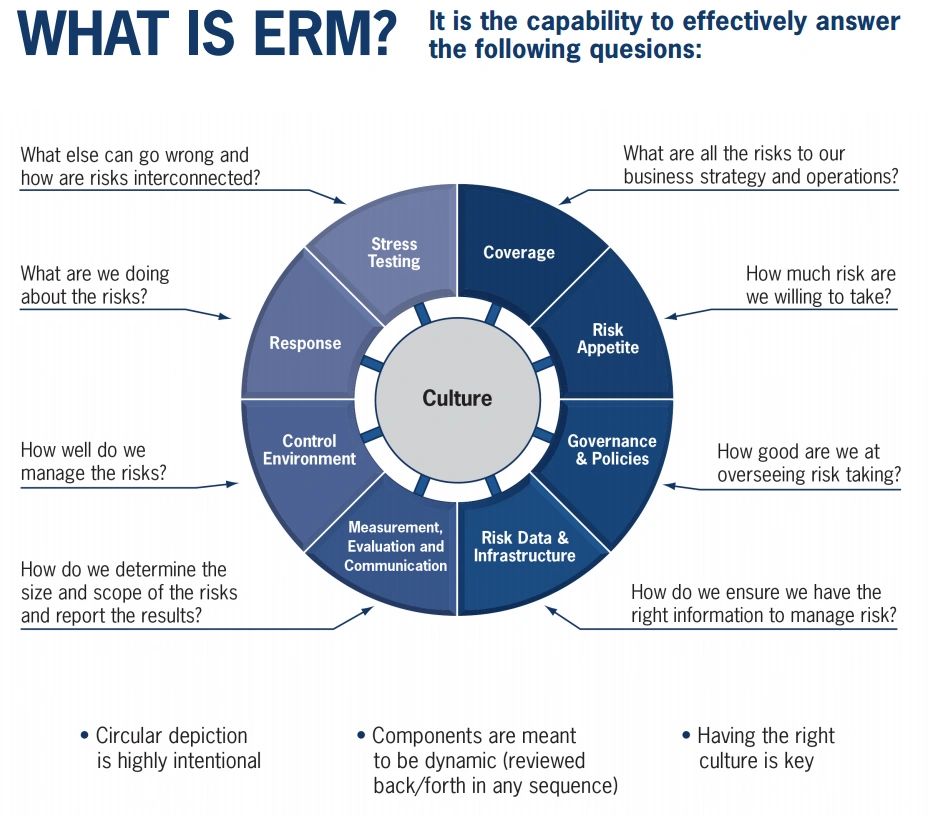

Erm Strategy

What is the strategy and objective setting component of ERM? · Analyzes Business Context—The organization considers potential effects of business context on. Client Needs · Develop an ERM maturity map and plan with actions to address key risk drivers · Build expertise within the organization and engage management. Enterprise Risk Management (“ERM”) is a strategic business discipline that supports the achievement of an organization's objectives by addressing the full. ERM is to challenge these assumptions and, moreover, to execute the strategy. ERM and strategic management are not two separate things. Rather, they are two. These risks are related to operations, tactics and strategy, respectively. Strategy sets out the long-term aims of the organisation, and the strategic planning. Alignment with corporate strategy: helping boards oversee risk as part of strategic planning and execution, not separate risk from strategy; Risk strategy and. Enterprise risk management is a strategic, risk-based approach that identifies, assesses, and manages organizational risks to prevent losses and seize. ERM's Global Leader of Sustainability and Risk, Sabine. Hoefnagel, has overall accountability for our strategic approach to risk, which includes those risks. ERM is an organizational approach to identifying, assessing, and managing risks for improved decision-making and business continuity, overseen by the Chief Risk. What is the strategy and objective setting component of ERM? · Analyzes Business Context—The organization considers potential effects of business context on. Client Needs · Develop an ERM maturity map and plan with actions to address key risk drivers · Build expertise within the organization and engage management. Enterprise Risk Management (“ERM”) is a strategic business discipline that supports the achievement of an organization's objectives by addressing the full. ERM is to challenge these assumptions and, moreover, to execute the strategy. ERM and strategic management are not two separate things. Rather, they are two. These risks are related to operations, tactics and strategy, respectively. Strategy sets out the long-term aims of the organisation, and the strategic planning. Alignment with corporate strategy: helping boards oversee risk as part of strategic planning and execution, not separate risk from strategy; Risk strategy and. Enterprise risk management is a strategic, risk-based approach that identifies, assesses, and manages organizational risks to prevent losses and seize. ERM's Global Leader of Sustainability and Risk, Sabine. Hoefnagel, has overall accountability for our strategic approach to risk, which includes those risks. ERM is an organizational approach to identifying, assessing, and managing risks for improved decision-making and business continuity, overseen by the Chief Risk.

ERM works to help clients understand and mitigate risks by maximizing stakeholders' involvement in the process and optimizing their input. According to the new representation, enterprise risk management is stated that when integrated with strategy development, establishment, and implementation of. strategy, and monitoring process. By identifying and proactively addressing risks and opportunities, business enterprises protect and create value for their. An effective ERM provides management with a system of oversight, control and discipline affecting strategic direction, operations, reporting and compliance. ERM Strategies is a consulting and research firm that provides its clients with a wide array of enterprise risk management services. Enterprise risk management (ERM) is the act of understanding and preparing for risks that may happen so that the enterprise can be prepared for the ups and. ERM works with clients to explore a change journey approach that uncovers and understands stakeholders' needs and motivations, to clearly map the value. ERM Roadmap: Five Steps to Enterprise Risk Management Process. ERM implementation is a continuous process of integrating business strategies designed to. An ERM program can help increase awareness of business risks across an entire organization, instill confidence in strategic objectives, improve compliance with. Strategic risks are those that either affect or are created by an agency's strategic plan. The ones that affect the agency's strategic plan can arise from. ERM Framework to day-to-day practices. This supplement, titled COSO Enterprise Risk Management - Integrating with Strategy and Performance: Compendium of. Unlock the power of Strategic Planning & Enterprise Risk Management. Powerful, easy and intuitive features for business users and executives. Monitoring ERM strategy is an ongoing activity that requires organizations to check all the data associated with risks daily to address problems before they. To evolve management of nature-related impacts across our supplier base in line with. ERM's Sustainable Supply Chain. Management Strategy and our commitment to. Risks are inherent in our business activities and can relate to strategic goals, business performance, compliance with laws and regulations, and the macro. Engage stakeholders, create business value. Markets expect ESG strategies to be built for real impact, rather than marketing purposes. ESG performance targets. Once a comprehensive ERM strategy is built, a regular board-level reporting and review process must be put in place. A unified view of enterprise-wide risk is a. A true ERM system therefore needs to be capable of identifying risk factor interactions and help people in the business make sense of them. An ERM strategy has. ERM is to challenge these assumptions and, moreover, to execute the strategy. ERM and strategic management are not two separate things. Rather, they are two.

Dealership Crm Software

ProMax Automotive CRM gives you everything your dealership needs to track leads, desk deals and sell more cars in one easy-to-use and award-winning software. Industry leading companies choose to partner with DP Customer Relationship Management for easy access to leads and tools, fast response time, and more. DealerSocket CRM gives you the freedom to tailor your experience based on your unique needs. Take control with configurable dashboards, checklists, and more. "DriveCentric is a fantastic automotive CRM. It allows for visibility into all facets of the customer journey. It is fully customizable to match your. Discover the best Auto Dealership CRM Software for your organisation. Compare top Auto Dealership CRM Software tools with customer reviews, pricing and free. ProMax's automotive Customer Relationship Management (CRM) simplifies your dealership software so you can get more leads, track and follow up on leads to. Zoho CRM helps automotive businesses and car dealership to generate more leads, streamline sales pipeline and offer an end-to-end customer experience. An automotive CRM is a customer service, sales, and marketing platform designed for the unique buying journey of car customers. Unlock the power of our automotive CRM software for car dealerships. Strengthen operations, customer relationships, & close more leads faster. ProMax Automotive CRM gives you everything your dealership needs to track leads, desk deals and sell more cars in one easy-to-use and award-winning software. Industry leading companies choose to partner with DP Customer Relationship Management for easy access to leads and tools, fast response time, and more. DealerSocket CRM gives you the freedom to tailor your experience based on your unique needs. Take control with configurable dashboards, checklists, and more. "DriveCentric is a fantastic automotive CRM. It allows for visibility into all facets of the customer journey. It is fully customizable to match your. Discover the best Auto Dealership CRM Software for your organisation. Compare top Auto Dealership CRM Software tools with customer reviews, pricing and free. ProMax's automotive Customer Relationship Management (CRM) simplifies your dealership software so you can get more leads, track and follow up on leads to. Zoho CRM helps automotive businesses and car dealership to generate more leads, streamline sales pipeline and offer an end-to-end customer experience. An automotive CRM is a customer service, sales, and marketing platform designed for the unique buying journey of car customers. Unlock the power of our automotive CRM software for car dealerships. Strengthen operations, customer relationships, & close more leads faster.

An automotive CRM (customer relationship management) is a specialized software solution designed to assist car companies in managing customer service, sales. FirmaoCRM -This CRM is versatile and can easily integrate with Salesforce, making data migration straightforward. It offers features for lead. The all-in-one CRM for automotive dealerships. Easily manage customers, sales, and marketing across your entire dealer group or a single location. HubSpot is an ideal solution for smaller dealerships and car rental agencies. This dedicated CRM platform can help establish long-lasting and trustworthy. An automotive CRM helps car dealers and salespeople attract those leads and move their customers down the sales pipeline faster. Automotive CRM (Customer Relationship Management) software is designed to support automotive companies in managing customer service, sales, marketing, and the. DealerCenter is a leading dealer management system software that caters to independent auto dealers for their inventory management, payment processing. Eleads, VinSolutions, OpLogic, Autobase, Dealersocket, Ford Directe, Higher Gear, Reynolds and Reynolds, SalesFroce, XRM, Dealer eprocess. A modern CRM combines analytics tools with data collection software to segment customers and send personalized messages based on their customer data and. List of 30 Best CRM Software in Auto Dealership Industry · Creatio · Salesforce · Oracle NetSuite ERP · Thryv · Zoho CRM · EngageBay. Dealership CRM systems help collect, organize, and manage customer data effectively. This includes contact information, purchase history, behavior tracking. Explore top automotive CRM by Podium and achieve better customer retention and enhanced communication. Pipedrive's automotive CRM solution provides a seamless car sales and car buying experience. Approach and track new leads, nurture customers at every. CentraHub AUTO is a powerful automotive software designed to revolutionize the way automotive businesses operate. Build stronger relationships and drive growth with an automotive dealership CRM partner that puts customers first. List of Best Automotive CRM Software (Free and Paid) · Pipedrive · RAMP Garage Management Software · HubSpot CRM · Salesforce Automotive Cloud · Zoho CRM. As a car sales business owner, you need a CRM solution that can help you manage your inventory, automate your sales process, and streamline your customer. Tailored for used car dealerships, Selly offers essential features not found in many pricier, franchise-focused CRMs. With Selly, dealers can efficiently manage. Upgrade your used car dealer software to efficiently consolidate customer emails, text messages, and recorded calls all in one centralized location.

Life Insurance Policy Length

This is insurance you buy for the length of your life. Unlike term insurance, whole life policies don't expire. The policy will stay in effect until you pass or. Some whole life policies let you pay premiums for a shorter period such as 20 years, or until age Premiums for these policies are higher since the premium. For example, the minimum age you can take out a policy with us is 18, and the policy must not end before your 29th birthday. Primerica's life insurance companies offer affordable term life insurance protection ranging from a year level premium policy all the way up to a year. Whole life insurance cost increases with age. Provides lifetime coverage as long as required premiums are paid. for the initial level premium period. The cost of term life insurance can be very affordable. In fact, a healthy year-old woman can get a $20, term life insurance policy for less than $8/month. The term can be for one year, or anywhere from five to 30 years or longer. You choose the length of the term. Term life policies pay a lump sum, called a death. A term life insurance policy is the simplest, purest form of life insurance: You pay premiums for a set year, year, or sometimes year time frame. With term coverage, you get short-term death benefit protection (often 10, 15, or 20 years), and your beneficiaries will receive a lump-sum death benefit if you. This is insurance you buy for the length of your life. Unlike term insurance, whole life policies don't expire. The policy will stay in effect until you pass or. Some whole life policies let you pay premiums for a shorter period such as 20 years, or until age Premiums for these policies are higher since the premium. For example, the minimum age you can take out a policy with us is 18, and the policy must not end before your 29th birthday. Primerica's life insurance companies offer affordable term life insurance protection ranging from a year level premium policy all the way up to a year. Whole life insurance cost increases with age. Provides lifetime coverage as long as required premiums are paid. for the initial level premium period. The cost of term life insurance can be very affordable. In fact, a healthy year-old woman can get a $20, term life insurance policy for less than $8/month. The term can be for one year, or anywhere from five to 30 years or longer. You choose the length of the term. Term life policies pay a lump sum, called a death. A term life insurance policy is the simplest, purest form of life insurance: You pay premiums for a set year, year, or sometimes year time frame. With term coverage, you get short-term death benefit protection (often 10, 15, or 20 years), and your beneficiaries will receive a lump-sum death benefit if you.

Term life insurance policies typically come in 10, 15, 20 or year lengths. You should pick the term length that best lines up with when you'll have. As we mentioned before, this type of policy generally provides coverage for a period ranging from 10 to 30 years. The death benefit is also fixed. Because. Term life insurance covers you for a set period of time (usually 10, 15, or 20 years), at a cost that might be lower than long-term protection. Trendsetter® Super · Issue ages: · Term Durations: , , , , and year · Coverage available: $25K–$10 million and up · No medical exam for up to. A term life insurance policy provides coverage for a specific period, typically between 10 and 30 years. It is sometimes called “pure life insurance. Since term insurance covers you for a limited period of time, it generally costs less than whole life. That can make it an affordable choice for people who want. Term Life Insurance from Fidelity is designed to provide financial resources to your family in the event of your death. Learn which coverage options fit. You can typically get term coverage anywhere from 10 years to 30 years, although 20 years is the most common. At Legal & General America (LGA), we're one of the. You could purchase term life insurance to cover a specific obligation, and a permanent policy for lasting insurance protection. IN THIS ARTICLE Term insurance comes in two basic varieties—level term and decreasing term. These days, almost everyone buys level term insurance. The terms “. Term insurance is the simplest form of life insurance. It pays only if death occurs during the term of the policy, which is usually from one to 30 years. Indeterminate Premium Whole Life: An indeterminate premium whole life policy is like a non-participating whole life plan of insurance except that it provides. A year term length is the most popular choice with Haven Term policyholders. For many of our customers who are in their early to late 30s, 20 years is just. With term life insurance you select a policy term, typically 10 to 40 years, that could cover a specific period in your life. Senior couple walks through the. Terms typically range from 10 to 30 years and increase in 5-year increments, providing level term insurance. Rates stay the same throughout the duration of your. This type of term life insurance provides cover for a set period of time, usually 10, 15, 20 or 30 years. The premium remains the same throughout the duration. Whole Life Insurance · It provides lifetime coverage. · It allows you to pay premiums at a fixed rate for as long as the policy is in force. · It accumulates cash. Some whole life policies let you pay premiums for a shorter period such as 20 years, or until age Premiums for these policies are higher than ordinary life. You'll need to choose a term length, and coverage will only last for the term you choose. A popular choice is to have the policy last as long as your children. Term life insurance is a type of life insurance policy that has a specified end date, like 20 years from the start date.

Advantage Project Management Software

Another significant advantage of project management software is risk mitigation. These tools provide managers with insight into a project's potential. Advantage Software Has Been Acquired by ladangmas234.site Advantage automates all aspects of accounting, billing, project management, digital asset management. Excellent core app for us. Team loves it. Outstanding technical support. Project management, accounting, workflow, routing, expenses, time tracking. PROS. Innovative solutions in the construction industry allow firms to gain a competitive edge by improving efficiency, resulting in better project management in real. Advantage agency software includes a robust and integrated project management system that provides flexible planning options, clear focus and transparency. Streamline workflows, optimize resources, and improve project outcomes with centralized project management and comprehensive reporting on Adobe Workfront. 10 Benefits of Using Project Management Software · 1. Better Communication And Team Collaboration · 2. Improved Resource Management · 3. Organized And. project success. Request a Demo. Benefits of Vantagepoint Project Management. Manage the Complete Project. Manage Complete Projects. Manage the entire project. 8 Benefits of project management software · 1. Improved planning and scheduling · 2. It helps establish clear goals · 3. Improved resource management · 4. Track. Another significant advantage of project management software is risk mitigation. These tools provide managers with insight into a project's potential. Advantage Software Has Been Acquired by ladangmas234.site Advantage automates all aspects of accounting, billing, project management, digital asset management. Excellent core app for us. Team loves it. Outstanding technical support. Project management, accounting, workflow, routing, expenses, time tracking. PROS. Innovative solutions in the construction industry allow firms to gain a competitive edge by improving efficiency, resulting in better project management in real. Advantage agency software includes a robust and integrated project management system that provides flexible planning options, clear focus and transparency. Streamline workflows, optimize resources, and improve project outcomes with centralized project management and comprehensive reporting on Adobe Workfront. 10 Benefits of Using Project Management Software · 1. Better Communication And Team Collaboration · 2. Improved Resource Management · 3. Organized And. project success. Request a Demo. Benefits of Vantagepoint Project Management. Manage the Complete Project. Manage Complete Projects. Manage the entire project. 8 Benefits of project management software · 1. Improved planning and scheduling · 2. It helps establish clear goals · 3. Improved resource management · 4. Track.

Take advantage of reusable project templates that provide starting points for projects, speeding and standardizing the creation process. Required items can be. In this guide, we'll compare some of the best project management software that help you manage tasks, collaborate with your team, and manage resources. With first-in-class Agency Accounting, Agency Project Management and Media Buying and Planning software systems, Advantage can connect and automate your entire. Advantage provides an all-in-one purpose-built software platform for managing advertising agencies, creative teams, public relations firms, and marketing firms. Project management tools can help you deliver higher quality outcomes on faster deadlines with a cohesive (& happy) team. What is Advantage? Advantage is an agency management software purpose-built for ad agencies, PR firms, media buying outfits and in-house creative teams. Amy Kozlowski, Project Manager at Herrero Builders. The benefits of Autodesk project management software for construction. Explore the advantages teams. advantage. But this also means it doesn't have quite the range of integrations with third-party software that Wrike does. Zoho Projects Gantt Chart. The. Advantage Aqua is a comprehensive agency management software designed to streamline operations, enhance visibility, and boost profitability. Advantage apart as a superior subscription & product order management solution Our project managers are standing by to help you get started with Advantage. Wrike is packed with an unrivaled range of features, including built-in resource planning, time-tracking, and budgeting features that help modern teams do more. Better Project Completion Rate: Project management software helps managers adhere to project management best practices, which can have tangible benefits. Stay on top of all tasks with Pipedrive's online project management software. make task management, progress tracking and team collaboration a breeze. The main advantage of project management is that it helps you to manage your projects effectively, enabling you to resolve problems more quickly. ADVANTAGE Management Center. Server-client based management software for the Window PC. Project Registration. Company. About Us · Careers. Client Login. Project management software fosters cross-team cohesion, increased efficiency, and a single source of truth for the entire product lifecycle. Jira is a complete. Take advantage of task automation. Want your team to spend time doing work instead of managing it? With Box, you can assign tasks, set due dates, and monitor. Zoho Projects is a cloud-based project management solution that helps teams plan, track, collaborate, and achieve project goals. Try our online project. Best free project management software for visually managing projects Learn more about how to use Asana for GTD and how to take advantage of Asana's hidden. If the benefits of the software don't outweigh the financial investment, it might not be a cost-effective solution for your business. Overkill for Small Teams.

Best Value Dog Insurance

Pawlicy Advisor provides free quotes, comparison charts, and help from licensed agents to get you the best pet insurance for your breed at the lowest rate. Reimagined pet insurance for dogs and cats. With unlimited payouts and robust coverage, you can access the vet care your pet deserves. Get a free quote! How To Get Cheap Dog Insurance: Top 5 Tips · Adjust the plan to fit your budget · Shop around for pet insurance discounts · Enroll your dog at a young age. Comments69 ; Pet Insurance: What it costs, what it covers, and how to find the best. The Money Resolution · K views ; Trupanion Pet Insurance. Lemonade Pet Insurance: everything you love about Lemonade now for cats and dogs. Instant claims and a digital experience driven by social good.:heart. We surveyed pet owners and analysed over cat and dog policies to reveal which companies offer the best pet insurance. Save £s on pet insurance, including for dogs, cats and horses. This MoneySavingExpert guide helps you compare the top deals to find cheap pet insurance. Through Progressive Pet Insurance by Pets Best, the least expensive cat plan provides accident-only coverage for $6 per month. It's better to buy pet. Telehealth - 24/7 access to veterinary experts, icon check, icon uncheck ; Popularity among pet owners · #1 choice, #2 choice ; Best value, icon check. Pawlicy Advisor provides free quotes, comparison charts, and help from licensed agents to get you the best pet insurance for your breed at the lowest rate. Reimagined pet insurance for dogs and cats. With unlimited payouts and robust coverage, you can access the vet care your pet deserves. Get a free quote! How To Get Cheap Dog Insurance: Top 5 Tips · Adjust the plan to fit your budget · Shop around for pet insurance discounts · Enroll your dog at a young age. Comments69 ; Pet Insurance: What it costs, what it covers, and how to find the best. The Money Resolution · K views ; Trupanion Pet Insurance. Lemonade Pet Insurance: everything you love about Lemonade now for cats and dogs. Instant claims and a digital experience driven by social good.:heart. We surveyed pet owners and analysed over cat and dog policies to reveal which companies offer the best pet insurance. Save £s on pet insurance, including for dogs, cats and horses. This MoneySavingExpert guide helps you compare the top deals to find cheap pet insurance. Through Progressive Pet Insurance by Pets Best, the least expensive cat plan provides accident-only coverage for $6 per month. It's better to buy pet. Telehealth - 24/7 access to veterinary experts, icon check, icon uncheck ; Popularity among pet owners · #1 choice, #2 choice ; Best value, icon check.

How can I get cheaper pet insurance? Choosing the cheapest pet insurance isn't always the best option. It's important to find coverage that suits your pet's. Pets Best offers several ways to customize your pet's coverage options. Insurance is available for dogs and cats older than 7 weeks, with no upper age limits. Best Value: ASPCA · Excellent pricing · Comprehensive coverage, including exam fees · 10% multi-pet discount · Covers most cured pre-existing conditions after Pet Insurance for Dogs · Fetch Canada. $, $ or $ annually · Furkin. As low as $ annually · Trupanion Canada. 25, $0 –. Most Affordable and Best for Dogs: Lemonade Pet Insurance · Most Comprehensive Pet Insurance: ASPCA · Best Pet Insurance for Cats: Odie Pet Insurance · Most. If your dog gets an autoimmune disease, you could pay up to $20, for treatments. The value of pet insurance in Massachusetts becomes more obvious when. How do I get the best value from my pet insurance? Choosing the right deductible, annual coverage amount and reimbursement rate is all about finding a sweet. On average, Embrace offers affordable monthly premiums, typically ranging from approximately $8 to $38 for most cats and $18 to $72 for most dogs. These. A MetLife Pet Insurance policy can potentially help you save, allowing you to make decisions about your dog's health without cost being the deciding factor. BEST VALUE. Complete Coverage. Injury & Illness Insurance. Designed to help with the costs of vet visits or emergency care when your pet gets sick or injured. Protect Your Furry Friend with Pet Insurance · Real pet insurance reviews from real pet owners · Access to more pet insurance providers · See the best pet. Compare the best value pet insurance plans from America's top providers in under 60 seconds - for free! Lowest prices guaranteed. As we're completely independent we don't favor one provider over another so you can be confident you are getting the best value and coverage for your pet. In. An Post Insurance offers great value pet insurance for Cats, Dogs, the family pets. Choose from 3 levels of cover for your best friend. Get a quote online. Get affordable insurance for your dog or cat through USAA. Find out more You can customize a policy to fit your needs and your budget. How You Can. Best Pet Insurance for Puppies: Pets Best Pets Best has three tiers of accident and illness plans, plus a high-value wellness add-on geared toward new pet. Trupanion medical insurance is your pet's BFF according to veterinarians surveyed across the country. Watch a short video and see how Trupanion pet insurance. We work hard to offer financial assistance to our clients. ; Pets Best · Customizable Accident, Illness, and Wellness pet insurance coverage. Easy claims process. Dog, cat and horse owners can find a policy that fits their budget and lifestyle with ASPCA Pet Health Insurance. This pet insurance company offers accident. As one of the oldest pet insurance companies on the market, ASPCA Pet Health Insurance is our pick for senior pets. The company also stands out because it has.

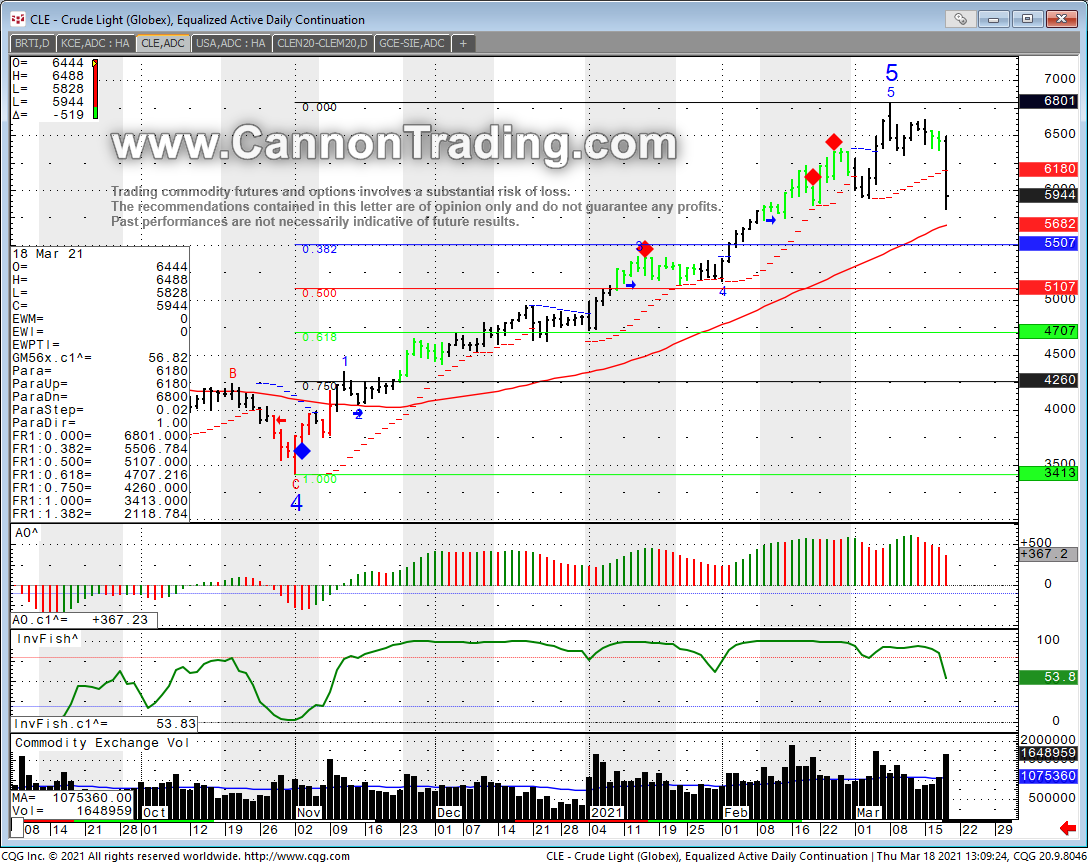

Crude Oil Futures Market

Get updated data about energy and oil prices. Find natural gas, emissions, and crude oil price changes Markets. Energy. Before it's here, it's on the. NYMEX Crude Oil Front Month · Price (USD) · Today's Change / % · Shares tradedk · 1 Year change% · 52 week range - WTI crude oil futures fell below $70 per barrel on Wednesday, hitting its lowest level since December , weighed down by concerns over rising supply. Get updated commodity futures prices. Find information about commodity prices and trading, and find the latest commodity index comparison charts WTI Crude Oil. Explore real-time Brent Crude Oil futures price data and key metrics crucial for understanding and navigating the Brent Crude Oil Futures market. View the latest Crude Oil WTI (NYM $/bbl) Front Month Stock Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Today's Crude Oil WTI prices with latest Crude Oil WTI charts, news and Crude Oil WTI futures quotes. Free intra-day WTI Crude Oil Futures Prices / WTI Crude Oil Quotes. Commodity futures prices / quotes and market snapshots that are updated continuously. Find the latest Crude Oil Oct 24 (CL=F) stock quote, history, news and other vital information to help you with your stock trading and investing. Get updated data about energy and oil prices. Find natural gas, emissions, and crude oil price changes Markets. Energy. Before it's here, it's on the. NYMEX Crude Oil Front Month · Price (USD) · Today's Change / % · Shares tradedk · 1 Year change% · 52 week range - WTI crude oil futures fell below $70 per barrel on Wednesday, hitting its lowest level since December , weighed down by concerns over rising supply. Get updated commodity futures prices. Find information about commodity prices and trading, and find the latest commodity index comparison charts WTI Crude Oil. Explore real-time Brent Crude Oil futures price data and key metrics crucial for understanding and navigating the Brent Crude Oil Futures market. View the latest Crude Oil WTI (NYM $/bbl) Front Month Stock Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Today's Crude Oil WTI prices with latest Crude Oil WTI charts, news and Crude Oil WTI futures quotes. Free intra-day WTI Crude Oil Futures Prices / WTI Crude Oil Quotes. Commodity futures prices / quotes and market snapshots that are updated continuously. Find the latest Crude Oil Oct 24 (CL=F) stock quote, history, news and other vital information to help you with your stock trading and investing.

Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Change value during the period between open outcry. Trading crude oil futures allows traders to speculate on the price movement of one of the world's most active commodities. Learn more from NinjaTrader. What makes Crude Oil futures attractive for me in terms of day trading is the fact that fear and greed are intensified in this market. That creates a ground for. Discover historical prices for CL=F stock on Yahoo Finance. View daily, weekly or monthly format back to when Crude Oil Oct 24 stock was issued. Learn more about crude oil futures trading, including crude oil futures contract specs and potential risks. Daily Limit, 15% above or below previous settlement ; Contract Size, 1, U.S. barrels (42, gallons) ; Months, All Months ; Trading Hours, p.m. - p.m. The NYMEX Division light, sweet crude oil futures contract is the world's most liquid forum for crude oil future trading, as well as the world's largest-volume. The current price of West Texas Intermediate (WTI) crude oil today is $ per barrel. Live charts, historical data, futures contracts, and breaking news. Get the latest Crude Oil (CLW00) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. Historical Prices for Oil (Brent) ; 09/02/24, , , , ; 08/30/24, , , , The current price of Light Crude Oil Futures is USD / BLL — it has risen % in the past 24 hours. Watch Light Crude Oil Futures price in more detail on. Get the latest Crude Oil price (CL:NMX) as well as the latest futures prices and other commodity market news at Nasdaq. Market participants not only buy and sell physical quantities of oil, but also trade contracts for the future delivery of oil and other energy derivatives. Get Crude Oil Front Month Futures (CLc1) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. The ICE West Texas Intermediate (WTI) Light Sweet Crude Oil Futures Contract offers participants the opportunity to trade one of the world's most liquid oil. Oil futures trading is the act of buying and selling crude oil futures. Traditionally, you'd trade crude oil futures if you were an oil producer or used oil as. Another major benefit of trading crude oil futures is the leverage it provides as well as efficient use of capital. As mentioned above, the current price of a. Follow today's crude oil price moves and key news stories driving oil price actions, as well as developments in the broader energy sector. Complete Crude Oil WTI (NYM $/bbl) Front Month futures overview by Barron's. View the CL.1 futures and commodity market news with real-time price data for. BRN00 | A complete Brent Crude Oil Continuous Contract futures overview by MarketWatch. View the futures and commodity market news, futures pricing and.

Social Security Financial Planner

Social Security is a key source of retirement income. Work with a CFP® professional on financial planning strategies to help make the most of your benefits. At Blue Bell Private Wealth Management, our social security services help you optimize your social security benefits which are important for retirement planning. We can help you set a plan to accomplish your retirement goals. Schedule a free minute consultation to discuss your social security strategy and set a. Choosing when to retire is an important decision. The best way to start planning for your future is by creating a personal my Social Security account. If you. Social Security Consultant Near MeGet the Most From Your Social Security Benefits With Knowledgeable Financial Advisors in St. Louis, MO. Also, a separate service for those needing both comprehensive financial planning and investment management. Recent News · U.S. Spousal Social Security For. We maximize your social security & make it easy! We show you how to make the best choices. Speak to an expert: Access to a certified social security advisor. I'm a Financial Planner: Here's Why My Clients Regret Taking Social Security at Age G. Brian Davis. Wed, Aug 14, 4 min read. In addition to being a top Social Security Advisor, Mary Beth is also a veteran personal finance journalist and certified financial planner. With that. Social Security is a key source of retirement income. Work with a CFP® professional on financial planning strategies to help make the most of your benefits. At Blue Bell Private Wealth Management, our social security services help you optimize your social security benefits which are important for retirement planning. We can help you set a plan to accomplish your retirement goals. Schedule a free minute consultation to discuss your social security strategy and set a. Choosing when to retire is an important decision. The best way to start planning for your future is by creating a personal my Social Security account. If you. Social Security Consultant Near MeGet the Most From Your Social Security Benefits With Knowledgeable Financial Advisors in St. Louis, MO. Also, a separate service for those needing both comprehensive financial planning and investment management. Recent News · U.S. Spousal Social Security For. We maximize your social security & make it easy! We show you how to make the best choices. Speak to an expert: Access to a certified social security advisor. I'm a Financial Planner: Here's Why My Clients Regret Taking Social Security at Age G. Brian Davis. Wed, Aug 14, 4 min read. In addition to being a top Social Security Advisor, Mary Beth is also a veteran personal finance journalist and certified financial planner. With that.

A financial planner can help you explore ways to supplement retire income from Social Security. 4. You'll have to wait a bit longer for full payout. Since. Stratos Wealth Partners, Wealth Management, Financial Planner, Financial Advisors. SOCIAL SECURITY PLANNING. Although many resources provide Social Security. Social Security and Medicare. In the video above Certified Financial Planner™ professionals abide by the Code of Ethics of the Certified Financial. Your full retirement age to receive Social Security benefits is based on the year you were born. What services do you offer at Nelson Financial Planning? In. A Registered Social Security Analyst® (RSSA®) will provide you with a unique Social Security plan, to help you decide on the optimal claiming decisions. Prepare for your retirement with our financial advisors who will help you with PERS and social security planning. Schedule a complimentary consultation. If you are younger than your FRA, Social Security will deduct $1 in benefits for each $2 in earnings you have above the annual limit ($17, in ). In the. Peter Weinbaum is your Social Security Expert Consultant -- Who can help Optimize your Social Security to Maximize Social Security Benefits. This means that as long as people are working and paying their taxes, Social Security will have a reliable influx of money to keep the program running – and you. National Social Security Advisor (NSSA). Designation Essentials FINRA is a Registered Trademark of the Financial Industry Regulatory Authority, INC. We'll ask questions and listen to better understand your situation. Then we can help outline what options you may have when it comes to Social Security. NARSSA provides education and resources to Social Security advisors to help clients maximize their Social Security benefits. Stratos Advisors are in in a unique position to assist clients with Social Security because of his or her unique understanding of a range of personal financial. social security benefits. Tracy Burgett. Certified Financial Planner, Platt Wealth Management. Restricted Application Eligibility. Steve was born in , so. Social Security), estate planning and risk management strategies. With the ability to transfer in, hold, manage, and invest both U.S. and Canadian. Social Security Planning · Notice: We are not the Social Security Administration. Questions relating directly to your Social Security account should be directed. We are a fiduciary Seattle financial advisor. As certified financial planners, we help with investments, tax planning, and retirement income. Your Social Security benefit and retirement savings should provide the remaining 20 percent to enable you to enjoy retirement security. Since members retiring. With a deep understanding of Social Security and its intricacies, TrueNorth Wealth will help you make informed decisions that align with your unique. "It's better to file for Social Security later rather than earlier," is common advice spread by financial advisors and laymen alike. After all, if you delay.

Closing Costs On A 2 Million Dollar Home

I've always been told to budget % of home value for closing costs. These can add a few hundred dollars. Remember, these are rough. Mortgage Closing Costs · Buyer's Attorney: Consult your attorney · Bank Fees: $ · Application Fee: $ · Processing Fee: $ · Appraisal Fee: $$1, . The best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. True enough, but even on a $, house. Buyer closing costs include mortgage-related costs such as a loan origination fee and other lender-related fees, private mortgage insurance, the down payment. If you buy a property in that range, expect to pay between $6, and $14, in closing costs after taxes. Data, Value. Average home sale price, $, Use our closing cost estimator to calculate the closing costs on your mortgage. Get the estimates & info you need with our closing cost calculator. Estimated closing costs for sellers are usually about 5% to 6% of the sale price in closing costs, while buyers typically pay between 2% and 5%. The bulk of the. In this scenario, you will most likely exceed 2% (or $15,) of fair market value in closing costs on a property purchase of $, when you add legal fees. We provide an overall closing costs estimate between 2% and 5% of the loan amount. We then factor in some of the most common closing cost charges. I've always been told to budget % of home value for closing costs. These can add a few hundred dollars. Remember, these are rough. Mortgage Closing Costs · Buyer's Attorney: Consult your attorney · Bank Fees: $ · Application Fee: $ · Processing Fee: $ · Appraisal Fee: $$1, . The best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. True enough, but even on a $, house. Buyer closing costs include mortgage-related costs such as a loan origination fee and other lender-related fees, private mortgage insurance, the down payment. If you buy a property in that range, expect to pay between $6, and $14, in closing costs after taxes. Data, Value. Average home sale price, $, Use our closing cost estimator to calculate the closing costs on your mortgage. Get the estimates & info you need with our closing cost calculator. Estimated closing costs for sellers are usually about 5% to 6% of the sale price in closing costs, while buyers typically pay between 2% and 5%. The bulk of the. In this scenario, you will most likely exceed 2% (or $15,) of fair market value in closing costs on a property purchase of $, when you add legal fees. We provide an overall closing costs estimate between 2% and 5% of the loan amount. We then factor in some of the most common closing cost charges.

How much are closing costs? Closing costs are typically 2% to 4% of the loan amount. They vary depending on the value of the home, loan terms and property. Closing costs are the fees paid by a buyer and a seller at the time of closing on a real estate transaction. · A buyer usually pays 3% to 6% of the home sale. This means that your total closing costs will vary depending on the loan size. For example, if you're taking out a mortgage of $,, you may likely end up. But for high-priced properties, such as those that sell for over a million dollars, the commission may be more like 4% to 5%. 2% of the contract price of the. 75% of that 37k could be property taxes and/or transfer taxes, in which case the rest of the closing costs could be a great deal. Closing costs are the expenses over and above the property's price that buyers and sellers incur to complete a real estate transaction. In Georgia, the average closing cost amount is $1, for a $, mortgage. That is just less than 1% of the loan amount and slightly more than the national. Use this closing costs calculator to estimate your total closing expenses on your home mortgage, including prepaid items, third-party fees and escrow. When considering homeownership, it's essential to be aware of closing costs, typically falling between 2% and 5% of your mortgage loan amount. However, it's. Most buyers can spend between 2 to 5 percent or even 6 percent of their home's price in closing costs. Paying up to 7 percent, meanwhile, is not unheard of. Closing costs, ranging from to 4% of selling price, are the legal and administrative costs you will need to pay when your house closes. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. These fees typically represent a significant amount of the total home purchase and usually cost between three to six percent of the mortgage. Lender Closing Costs: $3, ; Administration Fee, $ ; Underwriting Fee, $ ; Document Prep Fee, $ ; Commitment/Lender Rate Lock Fee, Between %. Most realtors and financial advisors tell you that closing costs will typically be in the range of % of the home value. This may seem reasonable enough. Generally speaking, you'll want to budget between 3% and 4% of the purchase price of a resale home to cover closing costs. Closing costs on a home can amount to thousands of dollars. They add up to between 2% and 5% for the buyer and 6% and 10% for the seller. Closing costs in South Carolina is estimated to range between $ to $ or 2% percent to 5% percent, based on the loan amount. People often overlook the scope of closing costs until we reach the end of their transaction. For Purchasers, closing cost generally range between 2% and 7% of. closing costs for home buyers and sellers. Our instant REAL Credit™ for ordering settlement services online has saved our neighbors upward of $18 million in.

What Is Section 1031

A exchange is very straightforward. If a business owner has property they currently own, they can sell that property, and if they reinvest the proceeds. Section of the United States Internal Revenue Code (IRC) allows real estate investors to sell investment or business property without triggering taxes. Under the Tax Cuts and Jobs Act, Section now applies only to exchanges of real property and not to exchanges of personal or intangible property. An. Section Requirements · You must hold the properties for productive use in a business or for the purpose of investment. · The replacement property must be of. The “” in the Exchange name refers to the section of the Internal Revenue code that permits such exchanges. The code states “ no gain or loss shall be. This type of like-kind exchange, or exchange named after the IRC Section allows real estate investors to reinvest the proceeds from a sale on a pre-tax. No gain or loss shall be recognized on the exchange of real property held for productive use in a trade or business or for investment if such real property. California generally conforms to Internal Revenue Code (IRC) section as revised by the Tax Cuts and Jobs Act of (TCJA) for exchanges initiated after. IRC section allows taxpayers to defer paying capital gains tax on the sale of real property used for business or held as an investment if it is exchanged. A exchange is very straightforward. If a business owner has property they currently own, they can sell that property, and if they reinvest the proceeds. Section of the United States Internal Revenue Code (IRC) allows real estate investors to sell investment or business property without triggering taxes. Under the Tax Cuts and Jobs Act, Section now applies only to exchanges of real property and not to exchanges of personal or intangible property. An. Section Requirements · You must hold the properties for productive use in a business or for the purpose of investment. · The replacement property must be of. The “” in the Exchange name refers to the section of the Internal Revenue code that permits such exchanges. The code states “ no gain or loss shall be. This type of like-kind exchange, or exchange named after the IRC Section allows real estate investors to reinvest the proceeds from a sale on a pre-tax. No gain or loss shall be recognized on the exchange of real property held for productive use in a trade or business or for investment if such real property. California generally conforms to Internal Revenue Code (IRC) section as revised by the Tax Cuts and Jobs Act of (TCJA) for exchanges initiated after. IRC section allows taxpayers to defer paying capital gains tax on the sale of real property used for business or held as an investment if it is exchanged.

(ii) the due date (determined with regard to extension) for the transferor's return of the tax imposed by this chapter for the taxable year in which the. Internal Revenue Code section Under Section of the United States Internal Revenue Code (26 U.S.C. § ), a taxpayer may defer recognition of. The transaction gets its name from Section of the U.S. Internal Revenue Code, which allows investors to defer capital gains tax on the proceeds of a. Section of the Internal Revenue Code is a valuable tool that allows you to defer payment of taxes on a gain from the sale of investment property, if you. The exchange funds can be used only to buy Replacement Property, pay closing costs or pay off a mortgage or deed of trust covering the Relinquished Property. Section provides a solution to the “lock-in” problem of the taxpayer who is unable or unwilling to sell investment property because of the burden that. A exchange gets its name from Section of the U.S. Internal Revenue Code, which allows you to avoid paying capital gains taxes when you sell an. These deferred exchanges are called exchanges which are governed by section of the Federal tax code. Section requires a new investment to be. Named after the section of the Internal Revenue Code (IRC) that defines its many rules and regulations, the exchange permits an investor to defer tax. Under Section of the Internal Revenue Code ; For example, real estate investors can exchange a small apartment building for a larger apartment project, for. A exchange gets its name from Section of the U.S. Internal Revenue Code, which allows you to avoid paying capital gains taxes when you sell an. A Section Exchange, also known as a Starker Exchange, allows investors to defer capital gains tax on certain investment property transactions. Exchanges have been part of the tax code since Section has permitted a taxpayer to exchange business-use or investment assets for other like-. The principal advantage of a Section tax-deferred exchange is the ability to use the entire equity of a property owned by a taxpayer to acquire replacement. Internal Revenue Code (IRC) Section provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar. Sec. Exchange Of Real Property Held For Productive Use Or Investment. I.R.C. § (a) Nonrecognition. The Internal Revenue Service (IRS) Section of the tax code is used by taxpayers who own residential properties that are held in the productive use of a business. Like kind properties are real estate assets that qualify under Section of the Internal Revenue Code for exchange and for the deferment of capital gains. Section requires the taxpayor not have actual or constructive receipt of the exchange proceeds. If a taxpayor can simply ask for and receive the funds at. This exchange practice outlined in Internal Revenue Code (IRC) Section allows investment property owners to sell their properties for like-kind properties.

1 2 3 4 5 6 7 8